Is is feasible to exploit stock price deviation from a purely statistical estimate of equilibrium? In his February 2014 paper entitled “Back to Black” (the National Association of Active Investment Managers’ 2014 Wagner Award second place winner), Arthur Grabovsky investigates exploitation of a model based on assumptions that: (1) unpredictable investor behavior sometimes makes stock price deviate from equilibrium; and, (2) price then tends to revert back to equilibrium. He defines equilibrium based on the conventional Capital Asset Pricing Model (CAPM), which holds that an asset’s returns depend on its alpha, market beta and an unexplained (random) noise factor. He employs daily double regressions over rolling windows of 60 trading days to measure how far and in what direction noise makes price trend away from its equilibrium alpha-beta relationship. He normalizes this drift as a number of standard deviations of the average noise factor. He then tests the tendency of stocks that drift too high (low) to revert to alpha-beta equilibrium and devises a long-only strategy to exploit prices that drift too low. He performs sensitivity tests on: (1) the threshold for exiting stocks that are reverting from “too low”; (2) the number of stocks an investor must hold for reliable portfolio performance; and, (3) different levels of trading frictions. Finally, he considers how different market conditions affect strategy performance. He selects the total return Russell 3000 Index as a market proxy and benchmark. Using daily prices for the market and a broad sample of U.S. stocks with market capitalizations over $100 million during January 2005 through December 2013, he finds that:

- An in-sample frictionless backtest during 2005 through 2009 that each day (1) ranks stocks into tenths (deciles) based on normalized deviation from CAPM equilibrium and (2) forms equally-weighted decile portfolios the following day indicates that:

- Underpriced (overpriced) stocks tend to outperform (underperform), and the relationship between deviation from equilibrium and future gross performance is mostly systematic across deciles.

- The relationship between deviation from equilibrium and future gross performance persists for at least five trading days but weakens over time.

- There is no variation across deciles in stock volatility, beta or market capitalization.

- A baseline long-only strategy tested during 2010 through 2013 that (1) initiates a long-only portfolio by buying the 50 most undervalued stocks and then (2) each trading day checking for reversion and selling at the next open any stocks that have reverted to only one-half standard deviation below equilibrium and replacing them with the most undervalued stocks not in the portfolio:

- Generates over four years a gross cumulative return of 126% (22.6% annualized) versus 79% (15.7% annualized) for the benchmark index. The active strategy beats the benchmark in three of four years.

- The active strategy is riskier than the market, with a portfolio beta of about 1.20 and larger drawdowns.

- Regarding sensitivity tests:

- Varying the number of holdings from 20 to 60 has little effect on performance.

- The system performs well on a gross basis for a wide range of sell thresholds.

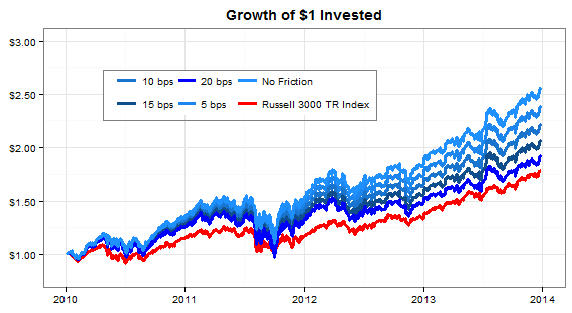

- The strategy achieves a higher terminal value than the benchmark for one-way frictions of up to about 0.25% (see the chart below).

- Potential refinements to the long-only strategy based on indications for five-day future cumulative return include:

- Strategy volatility is exceptionally high when VIX is high.

- Strategy outperformance concentrates during bull markets.

- The strategy performs better during risk-on (50-day moving average of the market above its 200-day moving average) environments than during risk-off (50-day below 200-day) environment, but does not underperform the market during risk-off.

The following chart, taken from the paper, tracks the performance of the baseline long-only trading strategy outlined above for levels of one-way trading friction ranging from frictionless to 0.2% (20 bps). The total friction for selling a reverting stock and replacing it with a new undervalued stock therefore ranges up to 0.4%. Results indicate that breakeven one-way trading friction is about 0.25%.

In summary, evidence suggests that investors may be able to exploit statistical drift of stock prices below their respective short-term CAPM equilibriums.

Cautions regarding findings:

- Ranking stocks daily according to their deviation from CAPM-based statistical equilibrium is data/compute-intensive and beyond the reach of many investors. If delegated, outputs may be costly, and still challenging to implement as a trading system.

- After allocating funds to 20 or more positions, some investors may not be able to realize even the “high” one-way trading friction of 0.2%. As noted, gross outperformance disappears with trading friction of about 0.25%.

- Strategy refinements suggest pauses, scale-backs and/or leveraging. Assessing such refinements would require analysis of overall investor portfolio(s) over extended sample periods (and costs for additional trading and leverage).

- The large drawdowns of the long-only strategy may be decisively unattractive for some investors.