In the introduction to his 2014 book entitled Global Value: How to Spot Bubbles, Avoid Market Crashes, and Earn Big Returns in the Stock Market, author Mebane Faber, ponders: “Can we or can’t we predict when a bubble is occurring? Below we [try] to find an objective way to identify bubbles, avoid their popping, and invest in their aftermath.” He focuses on the the cyclically adjusted price-to-earnings (CAPE) ratio (or P/E10) as a bubble indicator, including a variety of charts. Based on concepts originally developed and refined by Benjamin Graham, David Dodd, Robert Shiller and many others, he concludes that:

From Chapter 1, “Bubbles Everywhere”: “…a) investment bubbles have been around for centuries, and b) it is nearly impossible to stand aside while everyone else (your neighbor included ) is getting rich.”

From Chapter 2, “You Are a Bad Investor”: “…in bubbles and crashes, extremes in valuation are also accompanied by extremes in sentiment. Investors were most bullish when stocks were most overvalued at their peak and most bearish at market bottoms.”

From Chapter 3, “The CAPE Ratio”: “It very much matters what price one pays for an investment … Indeed, it is an almost perfect stair step – future returns are lower when valuations are high, and future returns are higher when valuations are low.”

From Chapter 4, “Valuation and Inflation”: “One of the factors that determines the valuation multiple investors are willing to pay is the inflation rate… When inflation is in the 1-4% “comfort zone,” investors are willing to pay a valuation premium compared to when there is high inflation or outright deflation.”

From Chapter 5, “Criticisms of the CAPE Ratio”: “The CAPE ratio is…a blunt tool, and should not be used to determine where to invest for the next few months. It makes much more sense to align the indicator with the measurement period, and in this case we are looking at 10 years.”

From Chapter 6, “Other Value Metrics”: “It is important to expand the opportunity set to include all of the countries in the world to determine whether it is possible to separate the currently cheap from the expensive. While the U.S. CAPE ratio signals caution, similar CAPE ratios for country stock markets around the world signal opportunity.”

From Chapter 7, “Does the CAPE Ratio Work Globally?”: “We examined [44] countries on a yearly basis since 1980, CAPE ratio levels, and future returns. The sample includes approximately 10 countries in 1980, 20 in 1990, 30 by 2000, and 44 by 2010. The results…largely confirm the US data. Buy low, sell high.”

From Chapter 8, “The Best of Times, The Worst of Times”: “Historically, investors have been rewarded for taking the risk of buying countries with extremely low valuations.”

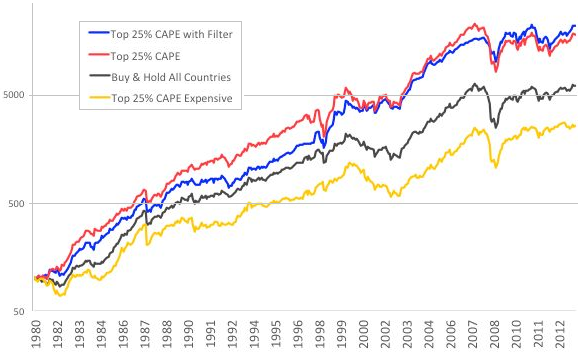

From Chapter 9, “A Global Stock Trading System”: “Investing in the cheapest countries produces significant outperformance compared to buy and hold market cap and equal weighted indexes – as well as significant underperformance for the overvalued countries.” [See the chart below.]

From Chapter 10, “Why This Matters to You”: “If you look at where we stand today with world valuations, the US is actually above the upper end of the range for expensive countries. …Will the current overvaluation signal another bear or perhaps a time to shift more assets to foreign markets? Time will tell.”

From Chapter 11, “Summary”: “Over periods of years and decades, it is evident that an investor’s real return is heavily dependent on the price paid for the asset. Investors can use the CAPE ratio valuation as a guidepost for both opportunities arising from negative geopolitical events, and a sanity check against bubbling stock markets.”

The following chart, taken from the book, compares gross cumulative values of equal initial investments in 1980 in four portfolios of country stock market indexes reformed annually from a universe of 44 indexes as they become available during 1980 through 2013:

- Top 25% CAPE – equally weighted fourth of indexes with the highest CAPE ratios.

- Top 25% CAPE with Filter – same as Top 25% CAPE, but substitutes cash for any index with CAPE > 18.

- Top 25% CAPE Expensive – equally weighted fourth of indexes with the lowest CAPE ratios.

- Buy & Hold All Countries – equally weighted portfolio of all indexes.

Results indicate that a portfolio of high-CAPE ratio indexes consistently outperforms an equally weighted benchmark, which in turn consistently outperforms a portfolio of low-CAPE ratio indexes.

In summary, investors with very long horizons may find the CAPE ratio valuation approached explored in Global Value an attractive approach to combining value and global equity diversification.

Cautions regarding conclusions include:

- Samples are generally small for use of an indicator with a 10-year measurement interval, especially for countries with short stock market histories.

- Some of the examples in the book are in-sample. An investor operating in real time based on either inception-to-date or rolling window historical data would pick different levels of CAPE as high or low at different times. See “P/E10 and Future Stock Market Returns”.

- As noted in the book, examples use country stock indexes that do not account for the costs of creating and maintaining liquid tracking funds.

- Tests of CAPE-based strategies in the book do not account for switching frictions. Incorporating estimates of such frictions, which vary over time (much higher in older data) would depress associated outcomes.

Robert Shiller updates freely available CAPE ratio data for the U.S. monthly. Mebane Faber updates global CAPE ratios quarterly for subscribers to The Idea Farm.

For other related research, see: