What do insiders regard as red flags for corporate earnings manipulation? In their May 2013 paper entitled “Earnings Quality: Evidence from the Field”, Ilia Dichev, John Graham, Campbell Harvey and Shiva Rajgopal report earnings quality insights from Chief Financial Officers (CFO) of publicly owned companies via 169 responses to an anonymous online survey, plus 12 telephone interviews. They invited survey participation via emails in late October 2011 and closed the survey in early December 2011. Firms of responding CFOs are mostly from the manufacturing (38%), banking/finance/insurance (16%) and healthcare/pharmaceuticals (8%) sectors, and about 27% have annual revenues greater than $10 billion. Based on survey results, CFOs believe that:

- High-quality earnings are sustainable and repeatable, as evidenced by consistent reporting practices, matching cash flows and absence of one-time items and long-term estimates.

- Industry and macroeconomic factors outside the control of management drive about 50% of earnings quality.

- In any given reporting period, about 20% of firms manipulate earnings by about 10% to misrepresent performance. About 60% (40%) of manipulations increase (decrease) earnings.

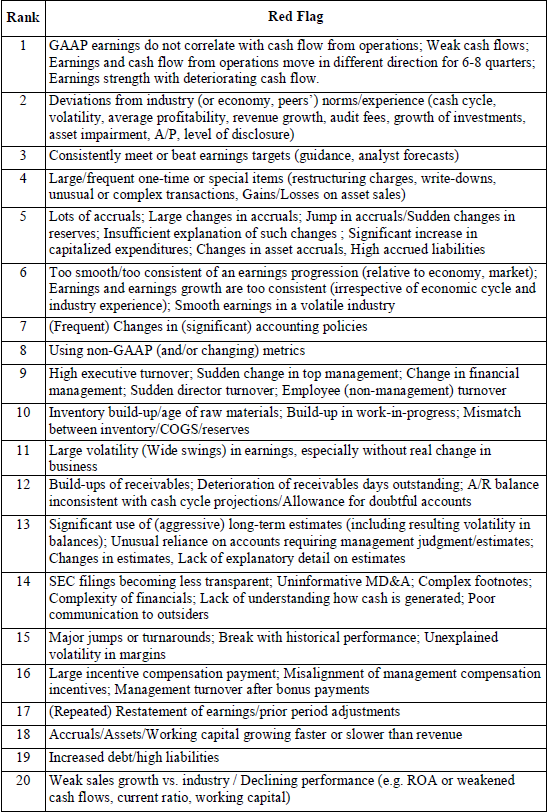

- The two most common red flags for manipulation are (see the table below for more): (1) persistent mismatches between earnings and cash flows; and, (2) deviations from industry and other peer norms.

The following table, taken from the paper, ranks the top 20 CFO-identified red flags for earnings manipulation (ranked by frequency of response for items with at least five responses).

In summary, results from a survey of public company CFOs suggest that earnings manipulation is fairly common and most often manifested as earnings-cash flow mismatches and departures from industry norms.

Cautions regarding results include:

- Survey respondents are largely self-selected and may not be representative.

- Even with identification of red flags, detecting earnings manipulation still requires considerable data and analysis.

- The research does not address how investors can exploit earnings manipulation once detected.

See “Prevalence and Indicators of Earnings Manipulation” for related research.