What is the state of cyclically adjusted price-earnings ratios (CAPE, P/E10 or Shiller PE), stock index level divided by average real earnings over the past ten years, across country equity markets worldwide? In his October 2013 paper entitled “What the Shiller PE Says About Global Equity Markets: Update 2013”, Joachim Klement updates expected returns for equity markets around the world based on P/E10 (see “Predictive Power of P/E10 Worldwide”). He adjusts P/E10 for economic conditions for each country via regression of P/E10 versus real GDP growth, real per capita GDP growth, real interest rate and inflation. Using stock index level, P/E10 and economic data for 20 developed and 18 emerging equity markets as available through September 2013, he finds that:

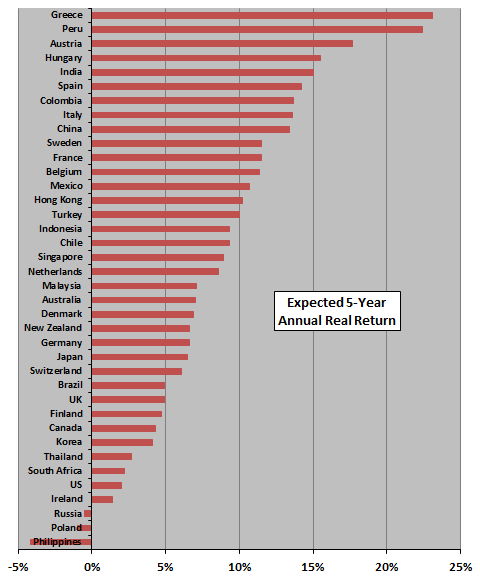

- Expected average real returns in local currencies over the next five to ten years are attractive (high single digits) for developed markets, except the U.S. Specifically (see the chart below):

- European equity markets (particularly France, Italy and Spain) are the most attractive in the world.

- The U.S. equity market is one of the most overvalued in the world, with an expected average annual real return of 2% to 2.5%.

- Expected returns for emerging markets in local currencies are somewhat below those for developed markets. Specifically:

- Many Asian markets (particularly Korea and Thailand) have low expected returns.

- Some smaller emerging markets (such as the Philippines and Poland) have negative expected real returns.

- Rising interest rates could lower these expected returns.

The following chart, constructed from data in the paper, ranks country equity markets by expected average annual real return in local currency over the next five years based on economically adjusted P/E10. Confidence level varies by country according to the available sample duration.

In summary, evidence from available data suggests economically adjusted P/E10 levels that are especially attractive in Europe, but not the U.S.

Cautions regarding findings include:

- Sample periods are very short for many countries relative to 10-year earnings measurement intervals as inputs, and for five-year and ten-year return measurement intervals as outputs.

- See “Predictive Power of P/E10 Worldwide” for additional background on methodology and associated cautions.

- Currency exchange rate movements may offset country returns for a global investor.