Should traders discard boring, rather than exciting (outlier), data? In his February 2013 paper entitled “Filtered Market Statistics and Technical Trading Rules” (the National Association of Active Investment Managers’ 2013 Wagner Award third place winner), George Yang proposes to filter out as noise the cluster of daily stock market returns near zero for technical analysis purposes. Specifically, he suggests excluding daily returns less than about 0.2 standard deviation in magnitude. He tests this proposition on three groups of widely used technical trading rules as applied to daily returns of the S&P 500 Index over the past 23 years, comprised of low (1990-1999)and high (2000-2012) volatility regimes. The groups of rules are:

- Two-day runs or streaks: positioning for mean reversion by going long (short) after two-day down (up) streaks.

- Dual moving average crossings: going long (100% short, 50% short or to cash) when a short-term moving average crosses above (below) a long-term moving average, focusing on a 200-day long-term average.

- Channel breakouts: when currently long (short), switch to short (long) when the daily close is below (above) the minimum (maximum) close over the past 150-250 trading days.

For all rules, he retains the number of sampled days in any filtered look-back interval by going further back in time. Using daily closes of the S&P 500 Index during 1990 through 2012 (5,797 trading days), he finds that:

- Excluding the boring daily returns of the S&P 500 Index as suggested means discarding about one quarter of observations, with the residual sample exhibiting a somewhat higher standard deviation and kurtosis (fat-tailedness) than the original sample.

- For the above two-day streak rule:

- Excluding daily returns with magnitudes less than 0.20 to 0.22 in-sample standard deviation, gross annualized returns from applying the rule to the filtered data are about 3% higher during 1990-1999 and 5% higher during 2000-2012 than those for the unfiltered sample. Excluding the noise data also reduces the number of trades and reduces maximum drawdown.

- Filtered data derived from two out-of-sample dynamic thresholds for noise (0.20 standard deviation of daily S&P 500 Index returns over the past 60 trading days; or, 0.22 S&P 500 Index implied volatility, as measured by VIX) also outperform the unfiltered sample.

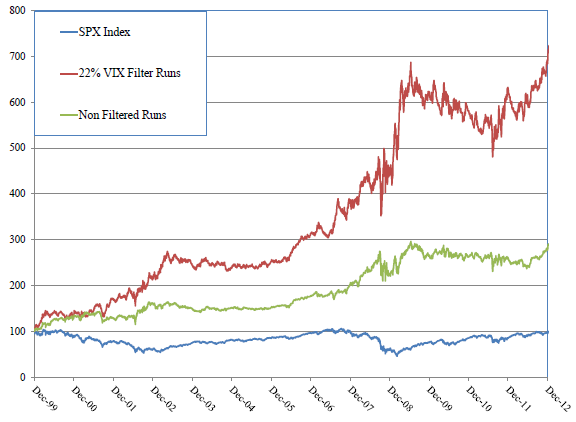

- The VIX-based dynamic filter provides the highest gross annualized returns during 1990-2012 and 2000-2012, outperforming the unfiltered sample by about 7% and index buy-and-hold by about 16% during 2000-2012 (see the chart below).

- For crossings of a 200-day moving average by moving averages of 5, 10, 20, 25, 30, 40 and 50 days (going 100% long after crossovers and 100% short, 50% short or to cash after crossunders) over the entire sample period, with exclusion of daily returns smaller than 0.25% in magnitude:

- Using filtered data beats using unfiltered data for all 21 variations by 0.2% to 4.7% annually.

- The strongest outperformance of filtered over unfiltered data (4.7% annualized) is for a 25-day short-term moving average and 100% short when under the 200-day moving average.

- Using unfiltered (filtered) data, 6 (18) of 21 rule variations have higher gross annualized returns than index buy-and-hold.

- However, filtering makes little difference for the popular Golden Cross (50-day/200-day).

- For channel breakout rules with look-back intervals of 150, 175, 200, 225 and 250 trading days over the entire sample period, with exclusion of daily returns smaller than 0.25% in magnitude:

- Using filtered data beats using unfiltered data for all five look-back intervals by 0.7% to 4.0% annually.

- Using unfiltered (filtered) data, none (all five) rule variations have higher gross annualized returns than buying and holding the index.

The following chart, taken from the paper, compares the gross cumulative values of $100 initial investments in three strategies during the 2000-2012 subperiod:

- SPX Index: Buy and hold the S&P 500 Index.

- 22% VIX Filter Runs: Apply the two-day streak rule only to daily returns not within 0.22 S&P 500 Index daily implied volatility.

- Non Filtered Runs: Apply the two-day streak rule to all daily closes.

Results show that filtered data far outperforms unfiltered data, and both beat buy-and-hold on a gross basis. Accounting for dividends would boost the first strategy relative to the other two. Accounting for trading frictions and shorting costs would materially depress the latter two strategies.

In summary, evidence suggests that technical traders may be able to improve performance by excluding from analysis days with very low (uninformative) returns.

Cautions regarding findings include:

- All returns are gross of trading frictions. Including trading frictions would reduce these returns commensurate with turnover (likely high for the two-day run rule). Results also ignore tax implications of trading.

- The S&P 500 Index does not account for dividends, to the disadvantage of buy-and-hold versus timing strategies.

- Results do not account for costs of shorting (including payment of dividends) as specified by the trading strategies. Accounting for these costs would reduce returns reported for these strategies.

- Any optimization of strategy parameters (daily return filter threshold, run interval, and look-back measurement intervals for SMA and channels) introduces data snooping bias, thereby impounding luck in results and overstating expected performance.

- The 2000-2012 subperiod is an “easy” one for market timing, such that a series of random timing signals is arguably the appropriate benchmark for discovering “intelligence” in trading rules. See “The 2000s: A Market Timer’s Decade?”, which finds that random timing frequently beats the market over this period.