How can investors use exchange-traded products to exploit equity market volatility? In the April 2013 version of his paper entitled “Easy Volatility Investing” (the National Association of Active Investment Managers’ 2013 Wagner Award runner-up), Tony Cooper explores the rewards and risks of five volatility trading strategies including simple buy-and-hold, price momentum, futures roll yield capture, volatility risk premium capture and dynamic hedging. He focuses on four exchange-traded notes (ETN) as trading vehicles:

- iPath S&P 500 VIX Short-Term Futures ETN (VXX) – inception January 30, 2009.

- VelocityShares Daily Inverse VIX Short-Term ETN (XIV) – inception November 30, 2010.

- iPath S&P 500 VIX Medium-Term Futures ETN (VXZ) – inception February 20, 2009.

- VelocityShares Daily Inverse VIX Medium-Term ETN (ZIV) – inception November 30, 2010.

He extends the histories for these ETNs back to 2004 by simulating their prices using historical VIX futures data. For signaling, he considers two indexes:

He ignores trading frictions triggered by strategy trades and portfolio rebalancing, and ignores return on cash when not invested. Using levels of VIX and VXV, VIX futures prices and ETN prices as available during 2004 through mid-February 2013, he finds that:

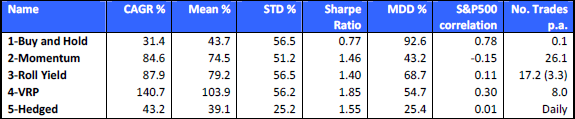

- The five volatility trading strategies are (see gross performance statistics in the table below):

- Buy and Hold XIV: XIV has an average annualized return of 31.4%. There are no interim trading frictions. However, XIV is volatile and experiences very large drawdowns.

- Momentum: Each day hold the one of the above four ETNs with the best return over the last 83 trading days, if that return is positive. If it is not positive, hold cash. This strategy incurs trading frictions and impounds some data snooping bias via momentum measurement interval selection (based on historical mean-variance and S&P 500 Index correlation attractiveness). This strategy is volatile and experiences large drawdowns.

- Roll Yield: Each day hold XIV when the VIX term structure is in contango (VXV/VIX > 1) and VXX when the term structure is in backwardation (VXV/VIX < 1). This strategy incurs trading frictions and impounds some data snooping bias via selection of the signal from a set of eight candidates (based on historical mean-variance attractiveness). This strategy is volatile and experiences quite large drawdowns. When VIX is near the contango/backwardation threshold, daily moves across this threshold can put the Roll Yield strategy serially in the wrong ETN. Use of a 10-day moving average for VXZ/VIX mitigates this risk.

- Volatility Risk Premium (VRP): Each day hold XIV if VRP > 0, else hold VXX, with VRP measured as current VIX minus the the 5-day moving average of historical volatility over the last 10 trading days. This strategy incurs trading frictions and impounds some data snooping bias via selection of the signal from a set of 18 candidates (based on historical mean-variance attractiveness). Use of a tuned, non-zero threshold improves performance but amplifies data snooping bias. This strategy is volatile and experiences quite large drawdowns.

- Hedged: Hold one of UBS E-TRACS Daily Long-Short VIX ETN (XVIX) or iPath S&P 500 Dynamic VIX ETN (XVZ), or implement more complex dynamic hedging. The dynamic hedging version of this strategy trades daily. This strategy is less volatile and experiences smaller drawdowns than the others.

- High return volatilities for these strategies cause large drags on cumulative returns. Sudden large moves in VIX can cause large short-term losses, and changes in VIX regime can disrupt the strategies over extended periods.

- Low correlations of volatility trading strategies with S&P 500 Index returns suggest their use as diversification assets, such as 55% equities, 35% bonds and 10% volatility.

The following table, taken from the paper, summarizes gross performance statistics for the five strategies outlined above during 2004 through mid-February 2013, using simulated prices for the ETNs prior to their respective inceptions. The performance metrics are:

- CAGR % – Compound Annual Growth Rate.

- Mean % – Mean annualized return (mean daily return multiplied by 252).

- STD % – Annualized standard deviation of returns (daily standard deviation multiplied by the square root of 252).

- Sharpe Ratio – With the risk-free rate assumed to be zero.

- MDD % – Maximum Drawdown based on daily data.

- S&P500 correlation – Correlation of daily strategy returns with those of the S&P 500 Index.

- No. Trades p.a. – Average number of trades/switches among ETNs or between ETN and cash per year.

For 3-Roll Yield, the average number of trades per year is 17.2 (3.3) when using the daily (10-day moving average) signal. The 5-Hedged strategy is for daily dynamic hedging.

In summary, evidence suggests that investors may find volatility trading strategies based on available ETNs attractive and useful for portfolio diversification.

Cautions regarding findings include:

- As noted in the paper, results do not include trading frictions (broker fees, bid-ask spread and impact of trading, with the latter two likely elevated during intervals of market stress). Incorporating these frictions would lower reported returns commensurate with trading frequency. Results also ignore tax implications of trading.

- As highlighted in the paper, optimization of strategy signals/parameters introduces some data snooping bias, impounding luck in historical tests and thereby overstate expectations. Testing the five basic strategies on the same data also introduces snooping bias, such that the best-performing strategy may incorporate luck.

- Trading in the easily accessible VXX and XIV may have grown so intense that these ETNs represents a substantial part of the demand for VIX futures, thereby changing the behavior of these futures. This feedback effect does not exist for simulated behavior of the ETNs prior to their inceptions, so results based on simulated prices may not be realistic.

- ETNs are financial instruments constructed from derivatives of a measurement of U.S. stock market expected volatility (not a real asset), with backing dependent on the financial health of the offeror.

See also the following:

- “Short-term VXX Shorting Signals?”

- “Shorting VXX with Crash Protection”

- “Capturing VIX ‘Misvaluation’ with ETNs”

- “Capturing VIX Futures Roll Return with ETNs”

- “Exploit VXX Deviation from Indicative Value?”

- “Enhanced VIX Futures ETNs”

- “Timing and Hedging the Roll Return for VIX Futures”

- “Exploiting VXX/XIV Tendencies”

- “Diversification with VIX Futures and Related ETNs”