How do “passive” stock indexes constructed from widely researched allocation rules fare against market capitalization weighting? In their March 2013 paper entitled “An Evaluation of Alternative Equity Indices – Part 1: Heuristic and Optimised Weighting Schemes”, Andrew Clare, Nick Motson and Steve Thomas compare the behaviors of eight alternative stock indexes formed from a common universe of relatively liquid U.S. stocks. They consider five heuristic (rules of thumb) and three formally optimized weighting schemes. The heuristic weighting schemes are: (1) equal; (2) diversity (a compromise between market capitalization and equal weights); (3) inverse volatility (based on standard deviations of monthly returns); (4) equal risk contribution (based on past return volatilities and correlations); and, (5) risk clustering (similar to equal risk contribution, but based on ten statistically similar clusters of stocks constructed from 30 industries). The formal optimization weighting schemes are: (6) long-only, constrained minimum variance (lowest expected volatility on the mean-variance efficient frontier); (7) long-only, constrained maximum diversification (designed to maximize portfolio Sharpe ratio); and, (8) constrained risk efficient (designed to maximize the ratio of portfolio downside deviation to standard deviation of returns). They reform indexes at the end of each year, using five preceding years of monthly data to calculate weighting parameters. They also consider a set of ten million randomly selected/weighted portfolios, reformed annually. Their benchmark is market capitalization weighting. Finally, they test the effectiveness of using a 10-month simple moving average (SMA) rule to generate timing signals for each index. Using monthly total returns for the 1,000 largest U.S. stocks re-selected annually during 1963 through 2011, they find that:

- All eight alternative indexes outperform the market capitalization-weighted benchmark. Specifically:

- Over the entire sample period, the benchmark has the lowest annualized gross return (9.4%), with inverse volatility and risk efficient having the highest (11.4% and 11.5%, respectively).

- The best (worst) decade for the benchmark index is the 1990s (2000s), with annualized gross return 17.6% (0.4%). Nearly all the alternative indexes underperform the benchmark during the early 1970s and the late 1990s.

- Equal weight (minimum variance) has the highest (lowest) standard deviation of gross annual returns of 17.2% (11.2%), with those of the other indexes ranging from 13.9% to 16.7%.

- The benchmark (minimum variance) has the lowest (highest) gross annualized Sharpe ratio and Sortino ratio. However, only inverse volatility, equal risk contribution and diversity beat the benchmark with high statistical reliability.

- Relative to the benchmark, all eight alternative indexes generate positive alpha, led by minimum variance at 0.48% per month. Equal weight, equal risk contribution, diversity and risk clustering all have betas close to one. Betas for the other four alternative indexes are much lower than one, with minimum variance the lowest at 0.51.

- Minimum variance (risk efficient) has the smallest (largest) maximum drawdown at 32.5% (56.0%), with those for the other indexes ranging from 41.1% to 50.2%.

- The alternative indexes generally tilt toward small stocks with high book-to-market ratios and low past volatilities compared to the benchmark index. Except for risk efficient (which strongly favors low-momentum stocks), they exhibit no momentum tilt.

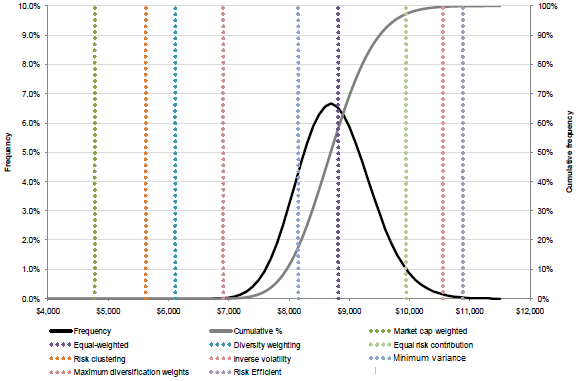

- Based on both gross terminal values of equal initial investments and Sharpe ratios, the vast majority of ten million randomly selected/weighted stock portfolios beat the market capitalization-weighted benchmark. The average random portfolio also beats half the alternative indexes (see the chart below).

- Applying to each index a rule specifying that funds are in the index (U.S. Treasury bills) when the prior-month index close is above (below) its 10-month SMA:

- Reduces volatility of all indexes by about a third and dramatically suppresses maximum drawdowns.

- Boosts the gross annualized return of the market capitalization-weighted benchmark by more than 1% and the gross annualized Sharpe ratio from 0.32 to 0.46.

- Makes minimum variance the winner based on both gross annualized return (11.6%) and gross annualized Sharpe ratio (0.69).

- The market capitalization-weighted benchmark has by far the lowest average annual turnover (5%), followed by diversity (8.5%). Equal weight, equal risk contribution and inverse volatility have average annual turnovers between 15% and 20%. The remaining four indexes have average annual turnovers ranging from 38% for minimum variance to 66% for risk efficient. Trading costs would have to be implausibly high to eliminate the performance advantages of the alternative indexes, particularly during the 2000s.

The following chart, taken from the paper, compares on the horizontal axis the gross terminal values of $100 initial investments in the market capitalization-weighted benchmark and the eight alternative indexes specified above, formed from a common universe of U.S. stocks during 1968 through 2011. It also shows the frequency (left vertical axis) and cumulative (right vertical axis) distributions of gross terminal values for ten million randomly selected/weighted portfolios formed from the same universe. Based on this metric, the best (worst) index is risk efficient (market capitalization). Inverse volatility is a close second.

The average randomly generated portfolio produces a gross terminal value of about $8,700, greater than those of the benchmark and half the alternative indexes. Nearly every random portfolio beats the benchmark. The equal risk contribution, inverse volatility and risk efficient strongly outperform the average random portfolio.

In summary, evidence suggests that alternative stock weighting schemes and random selection/weighting generally outperform market capitalization on a gross basis over the last 40+ years.

Cautions regarding findings include:

- Indexes do not include the management/administrative costs and trading frictions necessary to create tradable, liquid funds. These frictions vary considerably over the sample period (see “Trading Frictions Over the Long Run”). They also vary considerably across weighting schemes (due to different turnovers and liquidities), such that net findings may differ from gross findings. The authors do not analytically support their assertion that alternative indexes would outperform market capitalization weighting on a net basis.

- Use of the 10-month SMA for timing U.S. stocks arguably impounds data snooping bias from other research (see “10-Month SMA Reputation a Data Mining Artifact?” and “Is There a Best SMA Calculation Interval for Long-term Crossing Signals?”). Moreover, the study apparently ignores trading frictions for switching between stock indexes and Treasury bills and assumes feasibility of coincident signal generation and trading of 1,000 stocks.

See also “The 2000s: A Market Timer’s Decade?” for a test of random timing of the U.S. stock market.