What research is available on investment approaches, allocations and results for U.S. university endowments? In their January 2013 paper entitled “A Survey of University Endowment Management Research”, Georg Cejnek, Richard Franz, Otto Randl and Neal Stoughton summarize available research on university endowment money management and performance. They identify four streams of research: (1) governance structure and investment policy statement; (2) asset allocation; (3) performance; and, (4) spending. Based on this research, they conclude that:

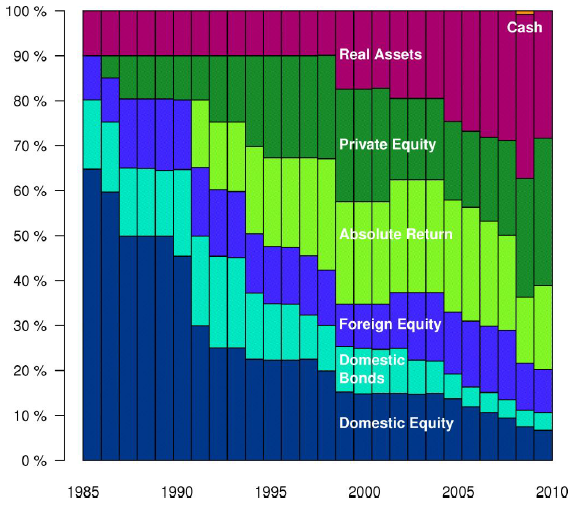

- All large university endowment funds exhibit trends toward alternative investments such as absolute return, private equity and real assets (see the first chart below).

- Overall, about 75% of university endowment investment returns derives from strategic asset allocation, about 15% derives from tactical asset allocation (market timing) and the balance derives from selecting specific assets.

- However, differences in performance among university endowments derives mostly from selecting specific assets, indicating variation in asset class expertise.

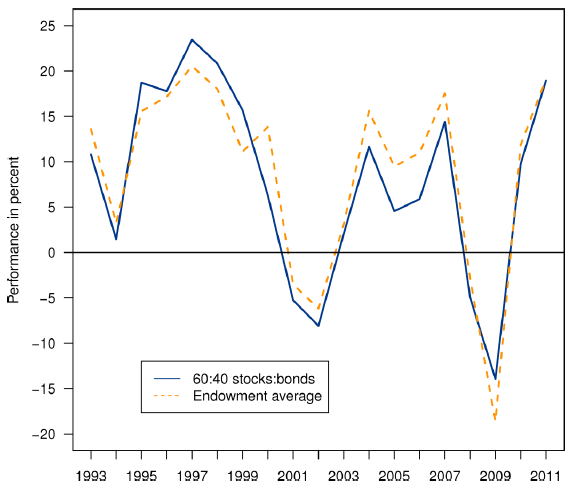

- On average, endowments outperform other institutional investors (see the second chart below), and large endowment beat small ones. Elite (such as Ivy League and high-SAT schools) exhibit persistently strong performance (see “University Endowment Performance: Strategic versus Tactical Allocation”).

The following chart, taken from the paper, summarizes the asset allocation evolution of the Yale University endowment (among the best performers) during 1985 through 2010. Over this period, allocation to domestic equity decreases dramatically, while allocations to absolute return, private equity and especially real assets increases markedly.

The next chart, also from the paper, compares the average annual university endowment return to that of an institution-like benchmark portfolio with a 60% allocation to the S&P 500 Index total return and a 40% allocation to U.S. treasuries with maturities of one to three years. The average endowment outperforms the benchmark in most years.

In summary, evidence from extant research suggests that the investment performance of elite U.S. university endowments is strong and persistent, and somewhat susceptible to emulation.

Cautions regarding findings include:

- Research is generally based on self-reported data at an annual frequency.

- While emulation of strategic allocations is methodologically straightforward, many investors do not have access to good proxies for alternative asset classes.

- Emulation of tactical asset allocation (market timing) and specific asset selection is problematic.