Has increasing use of gold as a portfolio diversifier changed the response of its price to crises? In their August 2012 paper entitled “The Destruction of a Safe Haven Asset?”, Dirk Baur and Kristoffer Glover examine the potential of investor behavior to extinguish the safe haven property of gold. Specifically, they consider how widespread inclusion of gold as a diversifier in investment portfolios affects gold price behavior in times of crisis. Based on theoretical conjecture and price data for gold during major financial market crises, they conclude that:

- Broader and deeper exposure to gold in investment portfolios over recent years undermines the safe haven behavior of gold via:

- Portfolio rebalancing after equity market crises (selling gold and buying stocks).

- Liquidation of positions in all risky assets, including gold, due to elevated risk aversion after portfolio shocks.

- Liquidation of assets, including gold, to obtain needed cash during financial crises.

- Concentration of liquidation in gold due to the disposition effect (preferring to sell winners rather than losers).

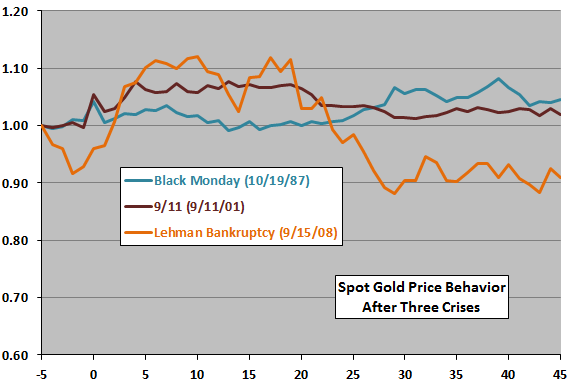

- With respect to the October 1987 stock market crash, the September 2001 terrorist attacks and the 2008 subprime crisis/Lehman bankruptcy (see charts below):

- Gold acts as an immediate safe haven, with responses arguably increasing over time.

- During the 2008 crisis, a substantial drop in gold price follows a strong safe haven response, perhaps due to portfolio margin calls or rebalancing.

The following chart, constructed from daily spot gold prices (normalized to 1.00 at outset), shows gold price evolutions from 5 trading days before (-5) to 45 trading days after (45) three major financial market crises. Results suggest that the initial safe haven reaction to crises is growing over time (perhaps a consequence of wider investor access to gold proxies), but that the safeness of the haven is increasingly transient (as argued in the paper).

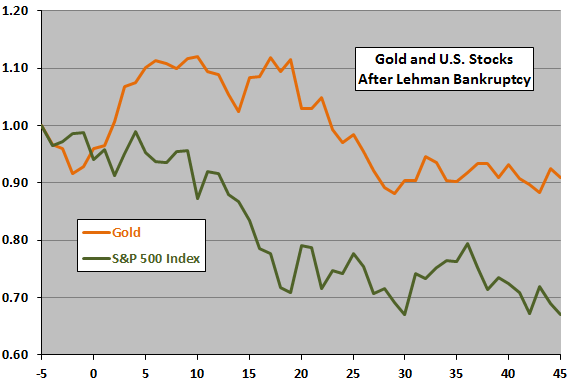

The next chart compares the evolutions of spot gold price and the S&P 500 Index based on daily data (both series normalized to 1.00 at the outset) after the 2008 subprime crisis/Lehman bankruptcy. Depending on the date selected as the onset of the crisis, the safe haven effect for gold lasts from roughly one week to one month.

In summary, evidence suggests that the safe haven effect for gold is increasingly transient, quickly giving way to typical post-crisis asset behavior.

Cautions regarding findings include:

- Crises are rare, with incomparable aspects, undermining confidence in empirical confirmation of arguments.

- The difficulty of assigning a specific start date to the 2008 financial crisis (with the Lehman bankruptcy one in a series of shocks) undermines the finding in the paper that the safe haven reaction to this crisis is dramatically compressed compared to reactions to prior crises.