Are there exchange-traded notes (ETN) based on S&P 500 Index implied volatility (VIX) futures, or combinations of such ETNs, that are attractive for absolute return and diversification? In the May 2012 version of their paper entitled “Volatility Exchange-Traded Notes: Curse or Cure?”, Carol Alexander and Dimitris Korovilas examine the behaviors of simple (first generation) and enhanced (second generation) ETNs constructed from VIX futures. They focus on: (1) roll return or yield, the loss (gain) of maintaining a position in VIX futures by continually rolling from a near to a far maturity contract when in contango (backwardation); and, (2) term structure convexity of VIX futures, the generally greater magnitude of roll return when rolling between contracts near to maturity versus between contracts far from maturity. To extend the sample period, they replicate recently available ETNs back to December 2005 using S&P constant-maturity VIX futures indexes and March 2004 using daily closes of VIX futures (debting respective annual ETN fees). Using daily closes for all VIX futures contracts, 30-day (VIX) and 93-day (VXV) S&P 500 implied volatility indexes as calculated by CBOE, S&P constant-maturity VIX futures indexes, one-month (VXX) and five-month (VXZ) constant-maturity VIX futures ETNs and two recently launched second-generation VIX futures ETNs (XVIX and XVZ) as available from late March 2004 through March 2012, they find that:

- First-generation VIX futures ETNs that simply track constant-maturity volatility indexes are amongst the riskiest of all exchange-traded products, especially those designed for leveraged tracking (such as TVIX). Since the VIX futures term structure is usually in contango, rolling usually incurs negative returns that compound to:

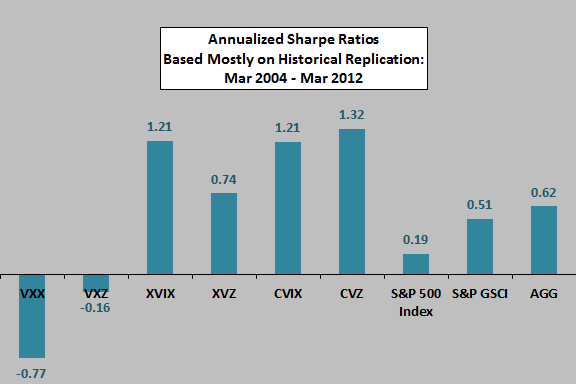

- Very negative cumulative returns for short-term VIX futures ETNs. For example, over the entire sample period the VXX construct generates an annual Sharpe ratio of -0.77.

- Due to term structure convexity, less severely negative cumulative returns for long-term VIX futures ETNs. For example, over the entire sample period the VXZ construct generates an annual Sharpe ratio of -0.16.

- Second-generation VIX futures ETNs (such as XVIX and XVZ) typically seek to exploit term structure convexity by selling short-term VIX futures and buying long-term VIX futures. Over the entire sample period:

- The XVIX construct generates an annual Sharpe ratio of 1.21, performing best when VIX futures are in contango.

- The XVZ construct generates an annual Sharpe ratio of 0.74, performing best when the VIX futures swing into steep backwardation.

- “Third generation” passive and active combinations of these second-generation ETNs combine exploitation of VIX futures term structure and roll return (see the chart below):

- A portfolio that allocates 75% of capital to XVIX and 25% to XVZ (apparently rebalanced daily) based on historical contango/backwardation frequencies (designated CVIX in the paper) generates a cumulative net return of 254% over the entire sample period, with average annual volatility 13.8% and annual Sharpe ratio 1.21.

- A portfolio that holds XVIX when the VIX term structure is in contango and XVZ when in backwardation (designated CVZ in the paper) generates a cumulative net return of 871% over the entire sample period, with average annual volatility 23.3% and annual Sharpe ratio 1.32.

- Indicative of potentially attractive diversification benefits, over the entire sample period, CVIX and CVZ portfolio returns exhibit:

- Strong negative correlations with S&P 500 Index returns.

- Small negative correlations with S&P Goldman Sachs Commodity Index (GSCI) returns.

- Small positive correlations with Barclay’s Aggregate Bond Fund (AGG) returns.

The following chart, constructed from data in the paper, summarizes annual Sharpe ratios (using the 90-day U.S. Treasury bill yield as the risk-free rate) over the entire March 2004 through March 2012 sample period for:

- First generation VIX futures ETNs (VXX and VXZ) that track constant-maturity VIX futures.

- Second generation VIX futures ETNs that exploit roll return (XVIX and XVZ).

- “Third generation” portfolios that combine XVIX and XVZ statically (CVIX) and dynamically based on roll return (CVZ).

- S&P 500 Index.

- S&P GSCI.

- AGG.

Since VIX futures ETNs do not exist for most of the sample period, results for these ETNs derive mostly from replication using VIX futures and indexes. Results indicate that the second-generation VIX futures ETNs and associated portfolios perform well both absolutely and relatively.

In summary, evidence from extensive replication back to the inception of VIX futures trading indicates that portfolios of second-generation VIX futures ETNs and portfolios formed from them offer attractive absolute returns and diversification properties relative to other asset classes by exploiting both roll return and term structure convexity.

Cautions regarding findings include:

- Replicated ETNs do not reflect any impact availability of real ones would have had on the VIX futures market. For example, the VIX futures market may not have been able to accommodate trading of ETNs in early years. Conversely, trading of these ETNs may be altering the behavior of VIX futures.

- While the paper describes the above performance results as “net of fees,” it appears that this description may not address all trading frictions that a typical investor would encounter (for example, in daily rebalancing of XVIX and XVZ positions to construct CVIX). It is also plausible that, if the ETNs had existed over the entire sample period, trading frictions and management fees may have varied with VIX futures market capacity.

- The CVIX allocation percentages are in-sample choices. An investor operating in real time may have allocated differently based on inception-to-date contango/backwardation frequencies.

See also the close related “Diversification with VIX Futures and Related ETNs” and “Exploiting VXX/XIV Tendencies”.