What is the safest way to exploit asset price momentum? In his April 2012 paper entitled “Risk Premia Harvesting Through Momentum” (the National Association of Active Investment Managers’ 2012 Wagner Award winner with different title), Gary Antonacci investigates systematic capture of upside volatility at the asset class level via a momentum/diversification/absolute return strategy that:

- Exploits momentum via long positions in winners, based on 12-month lagged total returns with no skip month, re-evaluated monthly.

- Maintains diversification by:

- Using indexes rather than individual securities; and,

- Holds the equally weighted winners from each the following pairs of competing indexes: gold versus long-term Treasury bonds; U.S. equities versus foreign equities; high yield bonds versus intermediate credit bonds; and equity real estate investment trusts (REIT) versus mortgage REITs.

- Mitigates risk by substituting Treasury bills (T-bills) for each pairwise winner that has not outperformed T-bills during the 12-month ranking interval.

Using monthly total returns for indexes constructed from targeted classes of equities, bonds, REITs and spot gold, along with contemporaneous 90-day Treasury bill yields, during January 1974 (or the earliest available) through December 2011, he finds that:

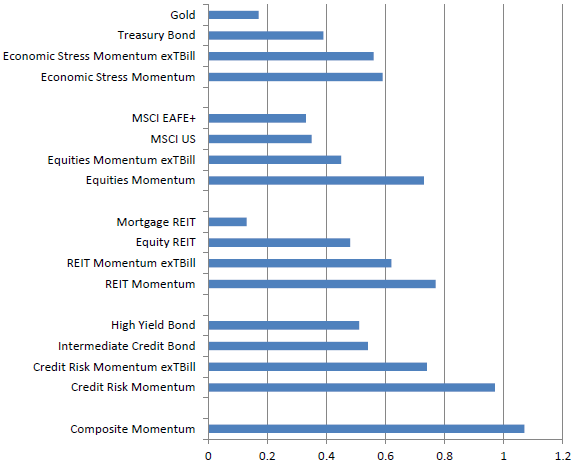

For each pair of asset classes separately (see the chart below):

- A strategy of picking the momentum winner improves gross risk-adjusted performance as measured by Sharpe ratio compared to the two competing asset class indexes.

- Augmenting this strategy by substituting T-bills for any pair winner that underperforms T-bills during the momentum ranking interval further increases gross Sharpe ratio and mostly reduces maximum annual drawdown.

- A composite strategy that holds the equally weighted pairwise winners (or T-bills for those winners that have underperformed T-bills) further boosts gross Sharpe ratio with very low maximum annual drawdown. This composite strategy easily outperforms an equally weighted portfolio of all asset classes plus T-bills.

- Switching frictions are low, with the average number of switches per year ranging from just 1.2 for high yield bonds versus intermediate credit bonds to 1.6 for gold versus long-term Treasury bonds and equity REITs versus mortgage REITs.

- Implementing the asset class indexes as tradable assets is not very costly, because the average annual expense ratio for corresponding exchange-traded funds (ETF) is about 0.25%.

- Results are generally robust to subperiods and use of six-month rather than 12-month past returns.

The following chart, taken from the paper, summarizes gross Sharpe ratios for:

- Each of the eight asset class indexes.

- A simple momentum strategy that each month picks the winner of paired assets (exTBill) based on lagged 12-month total return.

- A risk-mitigated version of the momentum strategy that substitutes T-bills for a pairwise winner that has not outperformed T-bills during the 12-month ranking interval.

- A composite strategy that each month equally weights the four risk-mitigated momentum winners.

Results demonstrate improvement from momentum, risk mitigation via an absolute return requirement and risk mitigation via diversification across asset class pairs.

In summary, evidence from backtesting with asset class indexes indicates that melding return momentum, diversification and an absolute return requirement enhances investment performance.

Cautions regarding findings include:

- Reported returns are gross, not net. While turnover of asset class proxies is low, the implication that current asset class ETF average annual expense ratios are representative of the frictions involved in translating indexes to tradable assets for backtesting is arguable:

- Such expense ratios might have been higher early in the sample period.

- Annual expense ratios do not include the trading frictions (broker fees, bid-ask spreads) involved in constructing fund portfolios. While frictions decline considerably in recent times, they are likely substantial during the early part of the sample period (see “Trading Frictions Over the Long Run”) and may still be material.

- Easy retail access to asset class diversification and asset class momentum strategies via ETFs may intensify competition for associated benefits and thereby increase asset class return correlations (reducing diversification benefits) and reduce momentum returns.

- Complex strategies may carry material data snooping bias, both direct (for example, from picking asset class pairs) and indirect (from data snooping in relevant prior research).

See also “Simple Asset Class ETF Momentum Strategy”, which includes cash (at the T-bill yield) as an asset class, thereby ensuring that the winner asset has a positive lagged return (but very rarely picking cash).