Does shorting the iPath S&P 500 VIX Short-Term Futures ETN (VXX) with crash protection (attempting to capture the equity volatility risk premium safely) work? To investigate, we apply crash protection rules to three VXX shorting scenarios:

- Let It Ride – shorting an initial amount of VXX and letting this position ride indefinitely.

- Fixed Reset – shorting a fixed amount of VXX and continually resetting this fixed position (so the short position does not become very small or very large).

- Gain/Loss Adjusted – shorting an initial amount of VXX and adjusting the size of the short position according to periodic gains/losses.

We consider two simple monthly crash protection rules based on the assumption that volatility changes are somewhat persistent, as follows:

- Prior Month Positive Rule – short VXX (go to cash) when the prior-month short VXX return is positive (negative).

- Prior Week Positive Rule – short VXX (go to cash) when the prior-week short VXX return is positive (negative).

For tractability, we ignore trading frictions, costs of shorting and return on retained cash from shorting gains. Using monthly closes for the S&P 500 Volatility Index (VIX) and monthly and weekly reverse split-adjusted closing prices for VXX from February 2009 through March 2020, we find that:

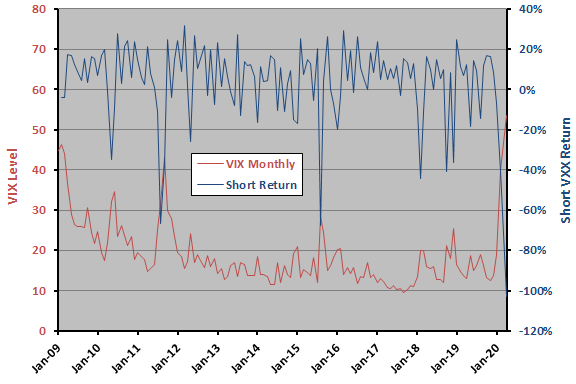

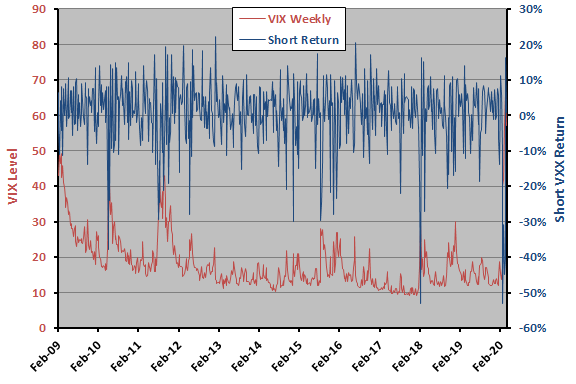

The following two charts show VIX levels and gross returns for a short position in VXX measured at monthly (upper chart) and weekly (lower chart) frequencies over the available sample period. Typical of strategies that are like selling insurance (collecting a volatility risk premium), returns for shorting VXX are mostly positive, but with occasional sharp losses driven by VIX spikes. The goal of crash protection is to avoid most of the effect of VIX spikes on VXX price.

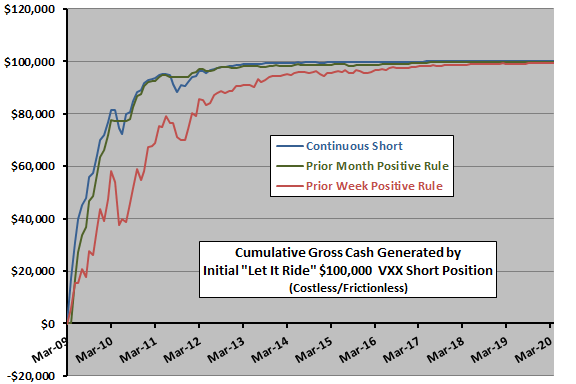

First, we consider the Let It Ride scenario.

The next chart compares cumulative gross profits from establishing initial $100,000 short positions in VXX at the end of March 2009 (after the first available monthly return) and making no further adjustments to this position except for applying the two crash protection rules as defined above. We select near month-end values of the Prior Week Positive Rule for comparison with the Prior Month Positive Rule.

The Prior Month Positive Rule perhaps offers a modest improvement over passive shorting (Continuous Short) by avoiding two drawdowns. The Prior Week Positive Rule is generally least attractive.

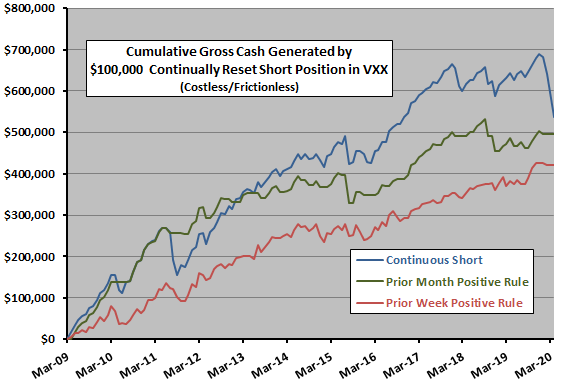

Next, we consider the Fixed Reset scenario.

The next chart compares cumulative gross profits from establishing initial $100,000 short positions in VXX at the end of March 2009. The Continuous Short and Prior Month Positive Rule both reset to $100,000 short at the end of each month. The Prior Week Positive Rule resets to $100,000 short weekly. Again, we select near month-end values of the Prior Week Positive Rule for comparison with the Prior Month Positive Rule.

While avoiding some drawdowns, the Prior Month Positive Rule has a lower terminal value than Continuous Short. Resetting short positions and “skimming” cash gains instead of growing the short position limits effects of crashes and appears reasonably attractive. However, an unlucky start, with a crash just after the initial short, could be unattractive.

Finally, we consider the Gain/Loss Adjusted scenario.

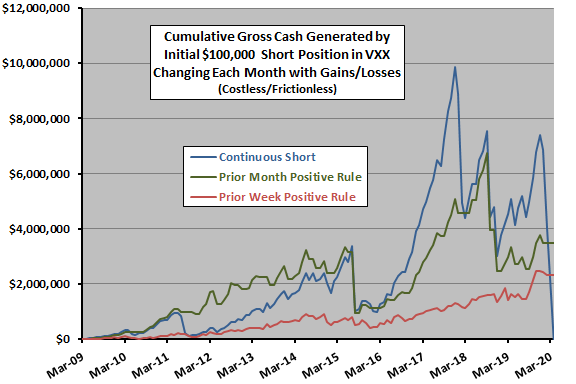

The final chart compares cumulative gross profits from establishing initial $100,000 short positions in VXX at the end of March 2009. The Continuous Short position and Prior Month Positive Rule increase or decrease at the end of each month according to the gain or loss during the month. The Prior Week Positive Rule adjusts according to gains and losses weekly. Again, we select near month-end values of the Prior Week Positive Rule for comparison with the Prior Month Positive Rule.

While not consistently the leader, the Prior Month Positive Rule has the highest terminal value. Both the Prior Month Positive Rule and Continuous Short suffer a discouraging 64% drawdown in August 2015. The Continuous Short suffers a 67% drawdown in February 2018 and a wipe-out in March 2020. The Prior Week Positive Rule mostly does not keep pace, but neither are its drawdowns as deep.

For another perspective, we look at average returns and volatilities.

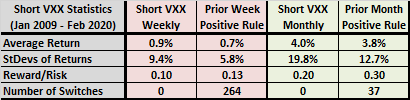

The following table summarizes average returns, standard deviations of returns, reward-to-risk ratios (average divided by standard deviation) and numbers of switches for continuous VXX shorting measured weekly and monthly and for the Prior Week Positive Rule and the Prior Month Positive Rule over the available sample period. Results suggest that simple crash protection may have value at the both frequencies. However, average returns are deceptive measures of expected performs for such wild return distributions.

In summary, evidence from simple tests on available data suggests that long-term Fixed Reset shorting of VXX with or without simple crash protection based on weekly or monthly data may be attractive.

Cautions regarding findings include:

- As noted, return calculations are gross. Incorporating reasonable trading frictions (minor for the Prior Month Positive Rule but likely material for the Prior Week Positive Rule) and shorting costs would reduce reported gains. Shorting of VXX may at times be constrained by brokers.

- As noted, initiation of VXX shorting during a high-volatility regime as above may be a lucky start.

- Some other VXX crash protection rule may work better. However, fitting a rule to historical data introduces data snooping bias. Sensitivity to a few crashes makes snooping easy and amplifies this concern.

- VXX is a financial instrument constructed from derivatives of a measurement for U.S. stock market expected volatility (not a real asset), dependent on the financial health of the offeror.