Does the S&P 500 implied volatility index (VIX) exhibit systematic behaviors by day of the week? In their February 2012 paper entitled “Day of the Week Effect on the VIX: A Parsimonious Representation”, Maria Gonzalez-Perez and David Guerrero apply methodologies that minimize sensitivity to outliers to examine VIX day-of-the-week patterns. Using daily closes of VIX and the S&P 500 Index during 2004 through 2008, they find that:

- VIX tends to be elevated on Monday and depressed on Wednesday and Friday.

- VIX tends to rise on Monday.

- After controlling for outliers, changes in VIX exhibit a roughly U-shaped weekly pattern, rising on Monday, falling on Tuesday and Wednesday, rising on Thursday and holding steady on Friday.

- The S&P 500 Index exhibits no significant day-of-the-week effect.

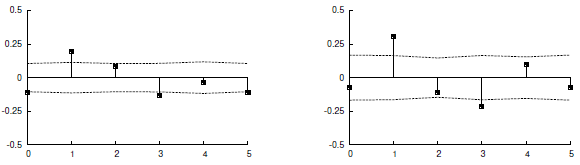

The following charts, taken from the paper, summarize VIX daily level tendencies (left chart) and daily change tendencies (right chart) over the entire sample period without controlling for outliers. Days 1-5 represent Monday-Friday. The principal effect of controlling for outliers is to expose a more pronounced U-shaped pattern in VIX change tendencies (right chart).

In summary, evidence from sophisticated pattern detection tests on five years of data exposes some day-of-the week effects for VIX (with Monday most unsual), but not for the S&P 500 Index.

Cautions regarding findings include:

- A sample of five years may not encompass the range of equity market conditions relevant to findings.

- The authors speculate that findings are exploitable, but they address neither methods nor costs of exploitation.

- It is not obvious that controlling for outliers translates to realistic exploitation.

- VIX is not directly tradable and findings for a tradable proxy may differ (see “VIX Calendar Effects” and “Exploit Short-term VIX Reversion with VXX?”, which find that daily behaviors of iPath S&P 500 VIX Short-Term Futures ETN (VXX) differ materially from those of VIX).

See also “VIX Seasonality” and “Any Recent Day-of-the-Week Anomalies?” for simple analyses over longer sample periods.