Market volatility tends to rise as returns fall. Does adding a proxy for short-term U.S. equity market volatility to a diversified portfolio improve its performance? To check, we add iPath S&P 500 VIX Short Term Futures (VXX) to the following mix of asset class proxies (the same used in “Simple Asset Class ETF Momentum Strategy”):

PowerShares DB Commodity Index Tracking (DBC)

iShares MSCI Emerging Markets Index (EEM)

iShares MSCI EAFE Index (EFA)

SPDR Gold Shares (GLD)

iShares Russell 1000 Index (IWB)

iShares Russell 2000 Index (IWM)

SPDR Dow Jones REIT (RWR)

iShares Barclays 20+ Year Treasury Bond (TLT)

3-month Treasury bills (Cash)

First, per the findings of “Asset Class Diversification Effectiveness Factors”, we measure the average monthly return for VXX and the average pairwise correlation of VXX monthly returns with the monthly returns of the above assets. Then, we compare cumulative returns and basic monthly return statistics for equally weighted (EW), monthly rebalanced portfolios with and without VXX. We ignore rebalancing frictions, which would be about the same for the alternative portfolios. Using adjusted monthly returns for VXX and the above nine asset class proxies from February 2009 (first return available for VXX) through April 2013 (only 51 monthly returns), we find that:

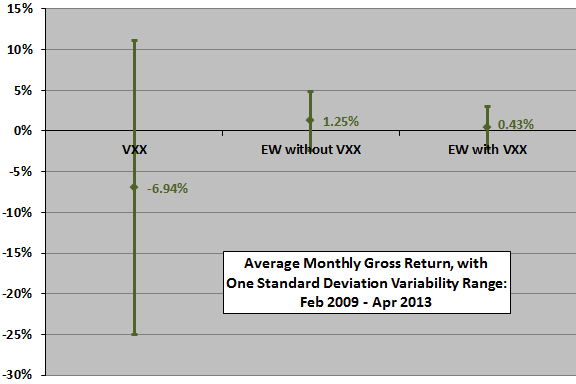

The following chart summarizes average monthly returns with variability ranges of one standard deviation for VXX and the EW portfolios without and with VXX over the available sample period. During this time, VXX generates a very negative average return with very high volatility. Adding VXX to the diversified EW portfolio reduces both return and volatility. The ratio of average return to standard deviation (return per unit of risk) is 0.34 (0.17) without (with) a VXX position.

The average pairwise correlation of VXX monthly returns with those of the other assets is a very low -0.34 over the available sample period. The low correlation derives from negative pairwise relationships with equity assets, RWR and DBC.

Per “Asset Class Diversification Effectiveness Factors,” the poor average return (low average pairwise correlation) of VXX indicates a bad (good) contribution with respect to portfolio diversification.

Sample size is small in terms of number of months, and especially, variety of market conditions.

What is the net result of these opposing effects?

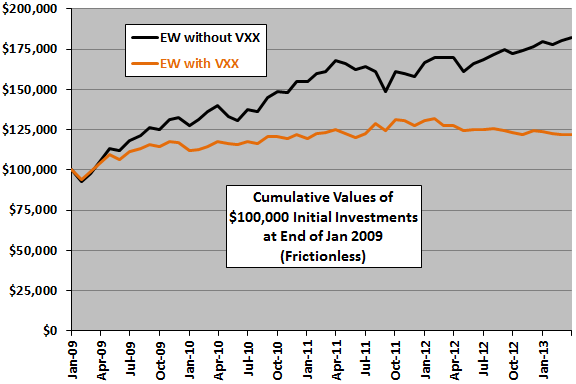

The next chart compares cumulative values of EW portfolios without and with VXX in the mix over the available sample period. Adding VXX does dampen return volatility, but loses based on terminal value over most recent intervals.

Again, sample size is small.

In summary, evidence from simple tests over a short available sample period does not support belief that adding a proxy for short-term U.S. equity market volatility to a diversified portfolio improves overall performance.

It may be that VXX volatility is such a drag on returns that a VXX position represents more a costly hedge than a diversifier.

Cautions regarding findings include:

- As noted, the sample period is very short in terms of market conditions (no bear markets). Stock market volatility has mostly trended down over the sample period. If VXX were available during 2008, findings might be different. In other words, over the long term, VXX may prove a more effective diversifier than found above.

- Including the trading frictions associated with monthly rebalancing would depress performance of both portfolios, depending mostly on portfolio size.

See also “Diversifying with Equity Volatility Exposure?”, “Feasibility of Diversifying Equities with Volatility Futures” and “Hedging Crashes: Volatility Futures vs. Index Puts”.