As described in “Monthly Stock Return Reversal Update”, evidence for a conventional monthly stock return reversal effect since 1990 is weak. Is there a way to enhance the effect? In their August 2011 paper entitled “Short-Term Residual Reversal”, David Blitz, Joop Huij, Simon Lansdorp and Marno Verbeek present a short-term reversal strategy based on deviations of individual stock returns from a rolling 36-month Fama-French three-factor (market, size and book-to-market) model (residuals) rather than raw returns. They standardize (suppress noisiness of) these residual returns by dividing them by their standard deviations over past 36 months. The past winner (loser) portfolio of the residual reversal strategy consists of the tenth of stocks with the highest (lowest) standardized residual returns. Using monthly returns and risk factors for common U.S. stocks priced above $1 with market capitalizations above the NYSE median over the period January 1926 through December 2008, and estimates of institution trading frictions for 1991-1993, they find that:

- The Fama-French factors systematically work against profitability and reliability of a conventional (raw return) monthly reversal strategy, costing it an average of about 0.24% per month over the entire sample period.

- A short-term reversal strategy based on residual stock returns enhances both profitability and reliability by avoiding this multi-factor headwind. Specifically, over the entire sample period, the residual monthly reversal strategy beats the conventional by:

- 0.37% per month based on gross average return (1.34% versus 0.97%).

- 0.09% per month based on gross three-factor alpha.

- More than double based on gross annualized Sharpe ratio (1.28 versus 0.62).

- Accounting for estimated institutional-level trading frictions:

- A conventional monthly reversal strategy is likely not profitable.

- Even though it generates high portfolio turnover, a monthly residual reversal strategy yields a significantly positive net annual return of more than 8% (breakeven round-trip trading friction about 0.56%).

- Monthly residual reversal strategy profitability is robust:

- Over time, exhibiting gross profitability in all eight sample decades and outperforming a conventional reversal strategy during each of these decades.

- For subsamples of the 500 and 100 largest stocks, generating net average returns of 0.67% and 0.81%, respectively, over the entire sample period.

- Across the calendar year (though strongest for January).

- For industry subsamples, improving the Sharpe ratio within each of ten industries compared to a conventional reversal strategy.

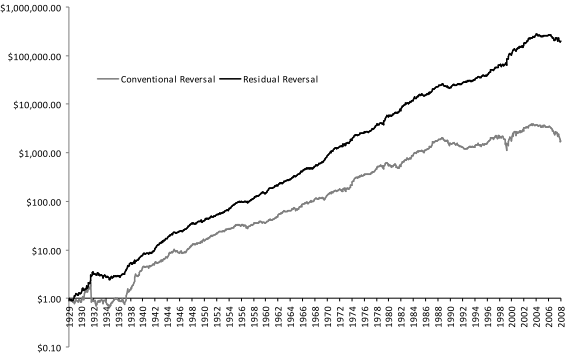

The following chart, taken from the paper, compares cumulative gross returns for hypothetical $1 initial investments in conventional and residual monthly reversal strategies in January 1929. The residual reversal strategy consistently beats the conventional reversal strategy and does not flatten during the last 20 years of the sample period.

In summary, evidence from an array of tests indicates that controlling for commonly used risk factors consistently enhances the performance of a monthly stock return reversal strategy, to the point of net (institutional) profitability even when restricted to large-capitalization stocks during 1990-2008.

Cautions regarding findings include:

- Monthly estimation of standardized, residual returns for a large sample of stocks is data-demanding and calculation-intensive.

- Calculations assume that investors can execute prior-month, risk-adjusted sorts just before monthly closes, and then take responsive positions at these same closes. This assumption may be problematic for some investors from calculation burden and trade execution perspectives. Delaying trades until the next trading day would systematically miss part of the turn-of-the-month effect.

- Many investors may not be able to achieve institutional levels of trading friction.

- Complex strategy implementations suggest the possibility of data snooping bias (both original and inherited from prior research). Robustness tests mitigate this general concern.

- Statistical significance tests assume well-behaved return distributions. To the extent that return distributions are wild, these tests lose meaning.