What is fair value for gold, which has no earnings and pays no dividend? In their 2005 paper entitled “The Price of Gold: A Global Required Yield Theory”, Christophe Faugere and Julian Van Erlach present a model of gold valuation based on a view of gold as a global store of real (inflation-adjusted) wealth. This model generates the price of gold as a function of the global investment yield required to produce a constant real after-tax return equal to long-term real growth in global GDP per capita. Capital flows to (from) gold depend on decreases (increases) in expected returns from other asset classes. Using quarterly data over the period May 1979 through May 2002, they find that:

- Over the sample period, mining operations sustain an approximately constant global stock of gold per capita.

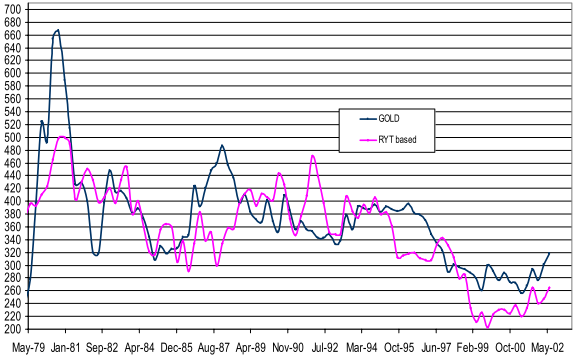

- The RYT model produces a 12% (8%) average absolute tracking error with respect to real gold prices (returns) measured quarterly over the sample period. (See the chart below.)

- By comparison, a mining cost approach to pricing gold produces little volatility and an average absolute quarterly tracking error of 16% over the sample period.

- The real price of gold varies with GDP-weighted world forward earnings yield. Major world events tend to have a large but fleeting impact on gold price.

The following chart, taken from the paper, shows nominal quarterly gold price in U.S. dollars and the corresponding Required Yield Theory (RYT)-modeled value during May 1979 through May 2002. The drivers of change in this calculation are expected global inflation rate, U.S. GDP as a fraction of world GDP and dollar exchange rate versus foreign currencies. The dollar exchange rate accounts for the highest frequency variations, with dollar depreciation (appreciation) driving the fair price of gold in dollars up (down). The mean absolute tracking error is 12%.

In summary, the Required Yield Theory models the fair value of gold more accurately than a mining cost model, with currency exchange rate and competing asset returns as key drivers of nominal and real gold price variation.

Cautions regarding findings include:

- The sample period is very short in terms of number of inflationary/disinflationary regimes.

- The model is descriptive rather than predictive for the price of gold and gold’s returns. An investor would need forecasts for input variables (such as the expected inflation rate, forward equity earnings yield, currency exchange rates) to use the model to predict gold price and gold returns.

See “Required Yield Theory of Asset Valuation” for application of RYT to the stock market and Treasury instruments.