There is a decades-long stream of academic research on equity analysts as sophisticated users of financial data, focusing on the usefulness of sell-side analyst earnings forecasts and stock recommendations. What is the gist of this stream? In his June 2011 paper entitled “Analysts’ Forecasts: What Do We Know After Decades of Work?”, Mark Bradshaw surveys research on equity analysts. Using results from dozens of studies spanning approximately four decades, he concludes that:

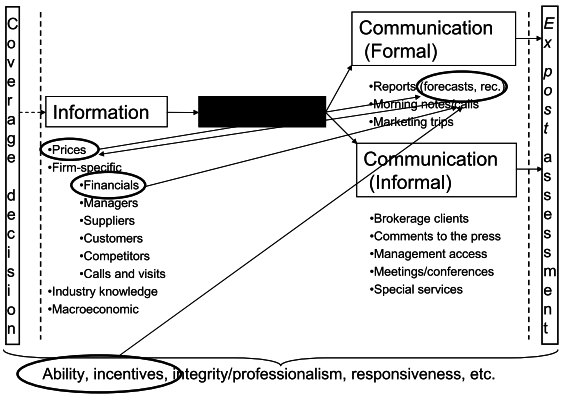

- The most studied analyst inputs (outputs) are prices and financial statement information (earnings forecasts and stock recommendations). More recent research investigate how analyst ability and incentives (biases) affect the processing of inputs into forecasts and recommendations. (See the chart below.)

- Numerous studies find that earnings forecasts are too high on average. Overall, however, this generality appears not to hold for short-term forecasts. Confusion between operating and as-reported earnings may be a factor in findings.

- After two decades of studies, researchers converge on a finding that analysts outperform time-series models in forecasting earnings, but the margin of victory is slim.

- After a series of initial studies finding no differences, researchers converge on a finding that some analysts are persistently more accurate than others.

- Numerous studies find that conflicts of interest materially affect analyst outputs, including pressures to: support employer investment banking relationships; curry favor with company management; generate trades; maintain institutional investor relationships (inhibiting opinion changes); and, treat companies that sponsor research favorably. There may also be bias inherent in familiarity with companies/management.

- There is no clear consensus on whether analysts tend to overreact or underreact to new information in forecasting earnings.

- Research on the value of stock recommendations is limited, and there is very little research on analyst processes (how they develop forecasts and recommendations).

The following chart, taken from the paper, summarizes the areas of emphasis in academic research on equity analysts. Studies focus on the most quantitative inputs and outputs, treating the analysis process itself mostly as a black box.

In summary, the stream of research on (mostly sell-side) equity analysts generally supports beliefs that: earnings forecasts tilt toward optimism; analyst forecasts are a little better than quantitative models; some analysts are consistently better than others; and, conflicts of interest materially affect forecasts.

Cautions regarding findings include:

- It is arguable that analyst influence is declining as availability of data and computing power increases for all investors.

- Pressures to publish and secure funding for future research may conflict researchers.