Is the accruals anomaly still on solid ground? In their paper entitled “The Accrual Anomaly”, Patricia Dechow, Natalya Khimich, and Richard Sloan review the origin of and subsequent research on the accruals anomaly. They characterize accruals as “the piece of earnings that is ‘made up’ by accountants” as opposed to the balance coming from cash flow. Using the original analysis and updated firm accounting and stock return data for the period 1970 through 2007, they find that:

- Cash flow, not accruals, drives persistence of company earnings outperformance. The accruals contribution is likely to dissipate.

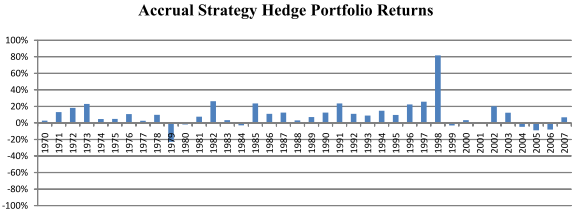

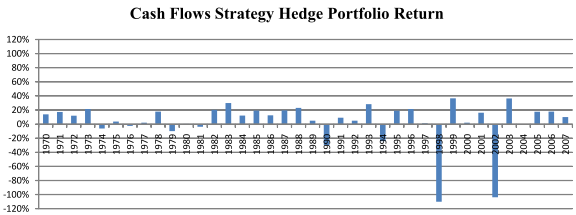

- An equal-weighted hedge portfolio that is long (short) the 10% of stocks with the lowest (highest) accruals for the prior year (data lagged four months to ensure availability), reformed annually, generates an average annual gross return of 11% over the entire sample period. A complementary strategy that is long (short) the 10% of stocks with the highest (lowest) cash flows for the prior year generates an average annual gross return of only 2.8%.

- Accruals strategy returns concentrate around strong earnings announcements by low-accruals firms (high-accruals firms tend to pre-announce earnings disappointments).

- Research since discovery indicates that the accruals anomaly:

- Is not fully appreciated, even by sophisticated investors/analysts.

- Is best exploited by aggregating accruals over the past two years.

- Is strongest for firms with: inventory-driven accruals; high working capital relative to total assets; low accruals persistence compared to cash flow persistence; large stock price response to earnings surprises; earnings manipulation accusations; and, low accruals due to special items (such as write-offs).

- Occurs in many international markets, more strongly in developed markets with accounting and legal systems similar to those of the U.S.

- Concentrates in small, thinly traded, volatile stocks that are costly to trade and difficult to short.

- Has been dissipating since 2000.

- Investor earnings fixation is the best-supported explanation for the accruals anomaly. Investors tend not to examine earnings quality.

The following two charts, taken from the paper, compare annual gross returns for hedge strategies as described above based on accruals (upper chart) and cash flows (lower chart) for a sample of 60,009 firm-years during 1970 to 2007. The accruals strategy, positive on a gross basis in 30 out of 38 years, exhibits low return risk. However, it unattractive since 1999, perhaps extinguished by hedge funds. Alternatively, it appears that the technology bubble of the late 1990s may be important to overall accruals strategy performance. The cash flow strategy is positive on a gross basis in 29 out of 38 years, but encounters disasters in 1998 and 2002.

In summary, evolving evidence indicates that the accruals anomaly, while large at a gross level, is difficult and costly to implement and may have disappeared over the past decade.

Cautions regarding findings include:

- Returns presented are gross, not net. Incorporating reasonable trading frictions would reduce returns. Relatively infrequent (annual) portfolio reformation mitigates this concern. However, as noted above, stocks that drive the accruals anomaly are those most difficult and costly to trade.

- Given the focus on annual returns, sample size is limited (especially if a multi-year phenomenon such as the technology bubble is important to anomaly performance). Also, statistical significance tests that assume tame stock return distributions are suspect to the degree that actual return distributions are wild.