Do online forums of arguably well-informed investors pay off for their members? In their February 2011 paper entitled “Talking Your Book: Social Networks and Price Discovery”, Wesley Gray and Andrew Kern study the sharing of valuation beliefs by professional investors via a social network. Specifically, they focus on ValueInvestorsClub.com, “designed to facilitate idea sharing among…250 [screened but anonymous] fundamentals-based managers (primarily hedge fund managers) who post detailed summaries of their investment analyses to the website. Once an idea is posted, it is visible to the other club members. Forty-five days after the idea is initially shared within this small community, the club grants public access to the investment thesis through a ‘guest access’ feature available to anyone with an email address.” Using approximately 2,000 long and 250 short recommendations for publicly traded common stocks shared via ValueInvestorsClub.com during 2000 through 2008, along with associated stock return, firm fundamentals and institutional ownership (SEC Form 13F) data, they find that:

- 87% of recommendations present analysis of intrinsic value via discounted cash flow, earnings multiples, growth-at-a-reasonable-price or similar valuation techniques. Other widely used indicators include tangible asset valuation (24%), open market share repurchases (12%), presence of net operating losses (5%), restructuring and spin-off situations (5%) and insider trading activity (5%).

- Recommendations tend toward manufacturing, services and financial firms.

- Long (short) recommendations have median market capitalization $393 million ($641 million), median book-to-market ratio 0.62 (0.34) and median return on equity 9% (12%).

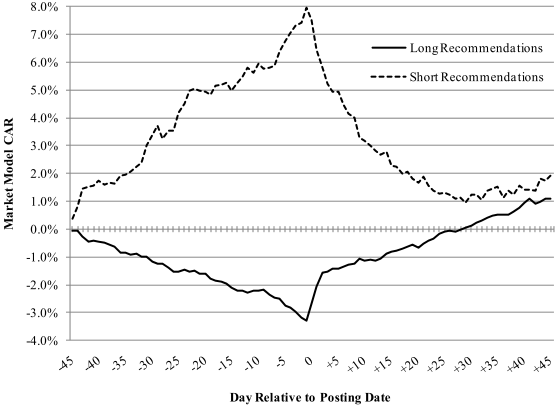

- During the two trading days after posting, long (short) stock recommendations earn an average gross market-adjusted return of 1.32%(-1.41%). During the 20 trading days after posting, these returns extend to 3.61%(-4.90%). (See the chart below.)

- For long (short) recommendations, positive (negative) gross abnormal returns concentrate in stocks with the highest (lowest) book-to-market ratios.

- For long recommendations, nearly all of the positive abnormal returns concentrate in the smallest firms. For short recommendations, gross abnormal returns are significant for smaller firms and insignificant for large firms. Institutional ownership data separately suggest that forum members act most aggressively on recommendations involving small firms.

- On the posting date and the next five trading days, trading volume for recommended stocks tends to be abnormally high.

- During intervals up to ten trading days after member recommendations become publicly available, average gross market-adjusted returns are modestly positive (less than 1%).

The following chart, taken from the paper, plots the average cumulative gross abnormal returns (CAR) for member long and short recommendations from 45 trading days before (-45) through 45 trading days after (+45) posting. Day 0 is the posting date. For this plot, “abnormal” means adjusted both for the equally-weighted market return (because recommended stocks tend to be small) and for the market betas of individual recommended stocks during the 200 trading days before the analysis interval.

As shown, the average CAR for long (short) recommendations during the 45 trading days before posting is -3.33% (+8.09%), versus +3.09% (-7.16%) during the posting date plus the next 45 trading days. In other words, members appear to count on reversals of recently realized misvaluations.

In summary, evidence from a fairly large sample of ValueInvestorsClub.com recommendations indicates that belonging to such a group can be profitable, with profitability concentrated within a few weeks after posting and among the recommended securities with the small market footprints.

Cautions regarding findings include:

- All return calculations are gross. Including trading frictions would produce materially lower net returns. Moreover, it appears likely that: (1) the stocks contributing most to gross abnormal returns are relatively illiquid and would therefore bear relatively high trading frictions; and, (2) there may well be a supply-demand mismatch that exacerbates illiquidity during the week after posting of recommendations.

- The concentrations of abnormal returns among recommended stocks with the smallest market capitalizations and extremes of book-to-market ratios suggest that an equally-weighted, beta-adjusted market portfolio may not sufficiently account for the size effect and value premium in assessing abnormality. In other words, size and book-to-market ratios may account for substantial portions of the abnormal returns.

- The examination of returns for only nine trading days after public release of recommendations seems inadequate to distinguish a drive-to-efficiency effect from an attention/herding effect that ultimately takes long (short) recommendations well above (below) equilibrium values. It would be interesting to see whether the abnormal returns found during the 45 trading days after posting revert over longer periods after “publication.”

See also the closely related “Methods and Results for ValueInvestorsClub.com Members”.