If you believe inflation is coming, should you shift assets toward commodities-oriented assets? In their November 2010 paper entitled “Are Commodities a Good Hedge Against Inflation? A Comparative Approach”, Laura Spierdijk and Zaghum Umar compare five measures of inflation hedging capacity as applied to commodities for investment horizons ranging from one month to ten years. They also investigate how these measures of hedging capacity relate. Using the monthly U.S. inflation rate based on the seasonally adjusted all urban Consumer Price Index, monthly returns for the S&P GSCI Total Return Index (proxy for a diversified, unleveraged, long-only commodity futures position) and its components, and the U.S. 3-month Treasury bill (T-bill) yield during January 1982 through August 2010, they find that:

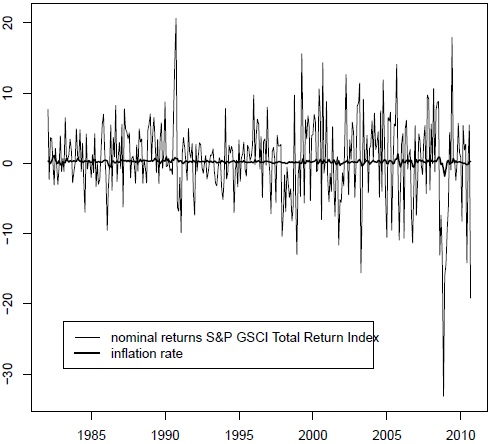

- Over the full sample period (see the chart below):

- The average monthly inflation rate is 0.24%, with standard deviation 0.27% (strongly non-normal).

- The average monthly nominal return on the S&P GSCI is 0.52%, with standard deviation 5.79% (substantially non-normal).

- The average monthly nominal T-bill yield is 0.40%, with standard deviation 0.22% (modestly non-normal).

- For four of the five measures of hedging capacity over the full sample period, the S&P GSCI provides an economically significant hedge against inflation, particularly for investment horizons of one year and longer.

- Differences in hedging capacity between the full sample period and subperiods derive largely from the strong positive correlation between inflation rate and commodity returns (both negative) for October, November and December 2008.

- The Non-Precious Metals sub-index appears to be the best inflation hedge for various investment horizons; when not the best hedge, it is usually second-best. Other commodities with significant inflation hedging capacity are Live Cattle and Livestock. Gold and Silver do not have significant inflation hedging capacity; nor do agricultural commodities such as Coffee, Cotton, Corn and Soybeans.

- Four of five hedging measures are essentially the Pearson correlation between inflation rate and nominal asset return.

The following chart, taken from the paper, plots monthly inflation rate and S&P GSCI return in percent over the entire January 1982 through August 2010 sample period. As noted above, commodity index returns are much more volatile than the inflation rate. The synchronized dip in late 2008 is materially disruptive, in Black Swan fashion, to the long-term relationship between the two series.

In summary, evidence indicates that commodities in aggregate (and non-precious metals, in particular) effectively hedge against inflation at reasonably long investment horizons.

Note that implementation of indexes as liquid securities, such as in this case iPath S&P GSCI Total Return Index ETN (GSP), involves trading frictions and fees (and risks) that may materially alter index-based conceptual findings.

Compare and contrast these findings with those for commodities summarized in “Hedging Against Inflation”. Note that the long-term analysis in this prior study focuses on spot prices for commodities rather than futures prices and that the sample periods of the two studies differ, potentially leading to different conclusions. The two studies appear to be most in agreement for a one-year investment horizon.