Does the tendency of stock market volatility measures to persist offer an exploitable short-term reversion to mean? In other words, can traders win on average by speculating that market volatility spikes will soon reverse? To check, we first test for short-term reversion of the implied volatility of the S&P 500 Index (VIX) over its available history. We then test for exploitability of any discovered reversion via the investable iPath S&P 500 VIX Short-Term Futures ETN (VXX), which seeks to replicate the return on short-term VIX futures. Using daily closes of VIX for January 1990 through December 2012 (5,794 trading days) and daily adjusted closes of VXX for February 2009 through December 2012 (987 trading days), we find that:

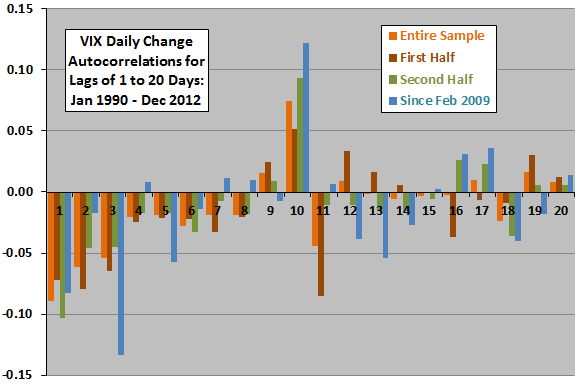

The following chart summarizes correlations between the change in VIX on a given trading day and the change in VIX on each of the next 21 trading days over the entire sample period, two equal subperiods and since February 2009 (inception of VXX). While the correlations are generally small, the cumulative effect of the mostly negative values for days 1 through 8, mostly persistent across subsamples, indicates meaningful reversion.

To investigate the size of this reversion, and the degree to which it is systematic, we look at average future 8-day future changes in VIX by ranges of prior-day change in VIX.

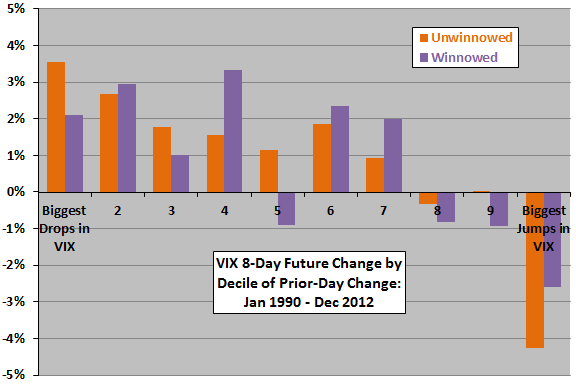

The next chart summarizes average future 8-day changes in VIX by decile of prior-day change in VIX (assuming a trader could estimate daily VIX change just before the close for action at the same close) over the entire sample period in two ways:

The unwinnowed results use all trading days with overlapping 8-day reversion intervals (578-579 observations per decile).

Overlapping measurement intervals can distort statistics. The winnowed results use every eighth trading day to eliminate reversion interval overlap (only 72-73 observations per decile).

Results suggest that a trader may be able to exploit short-term reversion of VIX with some reliability by betting on reversals of extreme daily moves. However, progression of average future returns across deciles is not very systematic for winnowed data.

There is no pattern in the volatility (standard deviation) of 8-day changes in VIX across deciles for either unwinnowed or winnowed results.

Can we use VXX to exploit the empirical VIX reversion?

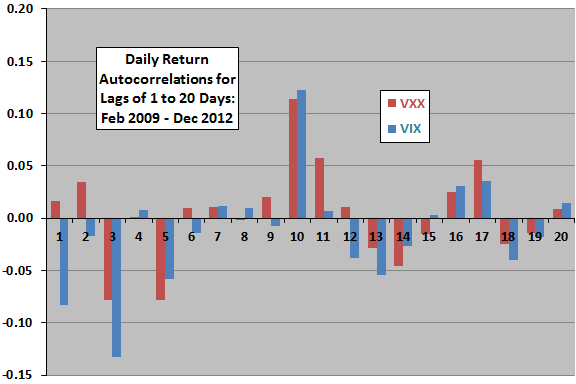

The next chart summarizes correlations between the return for VXX on a given trading day and the return for VXX on each of the next 21 trading days over the life of VXX. For comparison, it shows comparable correlations for VIX. Results indicate that VXX exhibits slight momentum rather than reversion during the first two days.

Do results leave any returns for a short-term reversion trader?

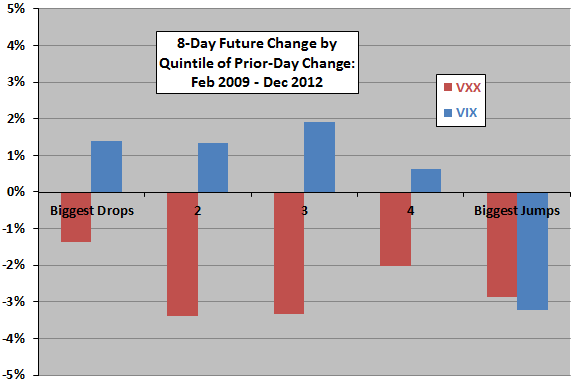

The final chart summarizes average future 8-day gross returns for VXX by quintile of prior-day returns for VXX over the life of VXX (195-196 observations per quintile). It also shows comparable results for changes in VIX. Data are unwinnowed (the sample is too small for winnowing). While reversion of VIX again appears potentially exploitable for extreme quintiles, VXX does not do the job. The gross 8-day reversion returns for all VXX quintiles are negative. Including trading frictions would worsen returns.

Volatilities (standard deviations) of 8-day returns/changes are notably higher for extreme quintiles than middle quintiles for both VXX and VIX, and volatilities of VXX returns are smaller than those for changes in VIX for all quintiles.

Reasons why VXX may not track VIX closely enough to exploit predictable VIX behaviors include:

- Differences between the behaviors of VIX and VIX futures, including the feedback of aggregate VXX trading.

- Trading frictions experienced by the VXX manager in implementing VXX.

- VXX management/administrative fees.

In summary, evidence from simple tests on available data does not support a belief that traders can systematically employ VXX to exploit short-term reversion of VIX.

Other approaches to exploiting short-term VIX reversion, or methods of exploiting other logical consequences of volatility persistence, may work better.