A reader suggested that we review the stock market commentary of Abby Joseph Cohen, partner and chief U.S. investment strategist at Goldman Sachs. Her public record, available most robustly via MarketWatch and Bloomberg.com, focuses on her year-end forward forecasts for the levels of major stock market indexes, such as the S&P 500 Index. She seems to derive her forecasts principally from earnings forecasts. All citations found, concentrated in the period 1999-2002, are bullish. Given the quantitative nature of her forecasts, we focus on Abby Joseph Cohen’s annual S&P 500 Index forecasts made near the end of each prior year versus two benchmarks: (1) the expert averages from the annual Business Week stock market forecast surveys (discontinued in 2008); and, (2) simple mechanical extrapolations of the actual historical annual performance of the S&P 500 Index. Using data for 1999-2011 (13 years), we find that:

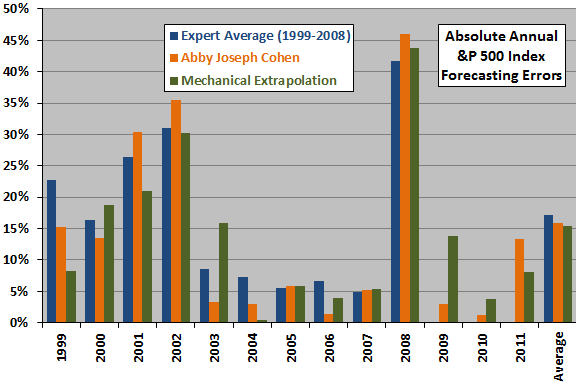

The following chart shows the absolute errors for Abby Joseph Cohen’s annual S&P 500 Index forecasts (orange columns) along with: (1) the average absolute errors for the experts from the same-year Business Week forecasts (blue columns); and, (2) the absolute errors for annual mechanical extrapolations of historical S&P 500 index performance (green columns). We perform the extrapolations for the latter benchmark simply by adding the average annual change in the S&P 500 Index from 1950 through the year preceding the forecast year. The chart shows that:

- For 1999-2000, Abby Joseph Cohen’s forecasts are not particularly accurate, but they were more accurate than the expert averages. In 1999, her forecast is too low; in 2000, too high.

- For 2001-2002, her forecasts are especially inaccurate (dramatically overoptimistic).

- For 2003-2007, her forecasts are fairly accurate, mostly beating the expert averages. For 2003-2005 and 2007, her forecasts are a little too high. For 2006, her forecast is slightly too low.

- For 2008, her forecast is dramatically too high.

- For 2009-2010, her forecasts are fairly accurate.

- For 2011, her forecast is not very accurat.

Note that the “Average” columns use data only for 1999-2008 because Business Week discontinued analyst forecast surveys after 2008.

There is slight evidence that Abby Joseph Cohen is more accurate than the average expert and about as accurate as a simple algorithm.

- During 1999-2008, her average annual absolute forecast error is 15.9%, compared to 17.1% for the expert average and 15.1% for the simple mechanical extrapolation.

- During 1999-2011, her average annual absolute forecast error is 13.6%, compared to 13.8% for the simple mechanical extrapolation.

Sample sizes are very small, so confidence in relative accuracies is very low. There is stronger indication (11 out of 13 years) that Abby Joseph Cohen’s forecasts tend to be too high rather than too low.

In summary, very limited evidence suggests that Abby Joseph Cohen is a little better as a stock market forecaster than her average peer, and about the same as a simple algorithm.

For comparability with the methodology used in Guru Grades, we also collect a higher frequency sample of Abby Joseph Cohen’s U.S. stock market forecasts since late 1998 to include intra-year revisions and assign subjective binary (right or wrong) grades to each forecast. The table below summarizes these forecasts and shows the performance of the S&P 500 Index over the 21, 63, 126 and 254 trading days after the publication date for each item. Red plus (minus) signs to the right of specific items indicate those that the market has subsequently proven right (wrong). Forecast sample is moderate, as is therefore confidence in the measurement of her accuracy. Media attention to Abby Joseph Cohen’s outlooks appears to vary such that the sampling frequency varies, thereby potentially introducing some bias.

See Guru Grades for a snapshot of the accuracies of other experts in forecasting the U.S. stock market, including links to evaluations of individual gurus.

| S&P 500 Index | ||||||

| Date | Comments from: Abby Joseph Cohen via MarketWatch.com, Bloomberg.com, CNBC.com et al. | 21-Day Return | 63-Day Return | 126-Day Return | 254-Day Return | |

| 1/8/11 | “The forecast is that by year-end the S&P 500 could be at about 1,450 and that will be an increase of almost 20% for the year.” | 4.0% | 4.6% | 3.9% | – | |

| 6/14/10 | We see a range of 1250 to 1300 [in the S&P 500 in 2010], and the market might not be at the high end at the end of the year… | 0.5% | 1.8% | 13.2% | 16.1% | + |

| 12/16/09 | Goldman’s U.S. portfolio strategy team expects the S&P 500 to be between 1250 and 1300. | 3.7% | 5.1% | 0.6% | 12.4% | – |

| 8/6/09 | the S&P 500 Index may rise as high as 1,100 this year… “We do think the new bull market has begun.” |

1.9% | 4.8% | 6.6% | 12.4% | + |

| 5/6/09 | Abby Joseph Cohen…see[s] the benchmark stock-index gaining at least 20% for 2009. | 2.2% | 9.4% | 13.4% | 26.1% | + |

| 12/17/08 | “Our estimate for the fair value of the S&P 500 Index is about 1,150 at year end.” | -11.0% | -13.3% | 1.5% | 23.2% | + |

| 6/10/08 | Cohen said this should help the S&P 500 index rise to 1,500 by the end of 2008, up from the 1,475 level at which the broad index started the year. | -7.7% | -6.7% | -35.5% | -30.3% | – |

| 12/4/07 | …the S&P 500 will hit 1,675 by the end of 2008… | -3.5% | -8.8% | -5.9% | -40.1% | – |

| 8/13/07 | She sees a year-end fair value on the S&P 500 of 1,600 and 14,000 on the Dow industrials. | 1.3% | 1.5% | -7.8% | -11.0% | – |

| 5/7/07 | …boosted her 2007 estimate for the S&P 500 by 3.2 percent to 1600. | 0.6% | -5.0% | 0.0% | -7.9% | – |

| 12/7/06 | The Standard & Poor’s 500 Index will climb to a record 1550 in 2007… The estimates imply a 10 percent increase for the S&P 500… “Equity remains attractive.” | 0.5% | 0.0% | 7.2% | 5.6% | – |

| 6/13/06 | …stocks [have] fallen too far and the S&P 500 [will] rebound to 1400 by year end. | 1.5% | 6.2% | 15.2% | 25.1% | – |

| 5/23/06 | …reiterated her positive disposition toward U.S. stocks… | -0.9% | 3.3% | 11.5% | 20.8% | – |

| 1/17/06 | “The U.S. stock market is underpriced,” Standard & Poor’s 500 Index may reach 1400 by the end of the year… | -0.2% | 0.2% | -3.8% | 10.9% | – |

| 12/5/05 | …expects an 11 percent advance in the S&P 500 through the end of 2006. | 0.9% | 1.1% | 0.1% | 11.5% | – |

| 1/3/05 | While she expects the economy to slow, she says a fair value for the S&P will be 1,325 points and predicts that operating earnings per share will rise 5 percent to 10 percent in 2005. | -0.7% | -2.2% | -0.6% | 5.9% | – |

| 11/3/04 | “The outcome on a near-term basis for equities is OK … We expect to see the usual January rally, which typically happens in November and December.” | 4.2% | 4.4% | 2.8% | 6.7% | – |

| 9/17/04 | It will climb in the last two or three months of this year… | -1.3% | 6.8% | 5.5% | 8.2% | – |

| 12/11/03 | Her fair value estimate for the S&P 500 Index is 1,250 for the year-end 2004. | 4.7% | 4.6% | 5.0% | 12.6% | – |

| 12/18/02 | …the S&P 500 should hit 1,150 (versus the current 910 or so) by the end of 2003… | -0.4% | -1.7% | 11.6% | 22.6% | – |

| 10/9/02 | …lowered her 12-month target on the S&P 500 to 1,150 from 1,300. “…share prices already reflect ugly scenarios and that the large risk premium embedded in share prices provides a cushion.” | 16.2% | 17.1% | 11.5% | 34.6% | – |

| 7/21/02 | …U.S. stocks are going to head higher. “…stock prices are today priced too cheaply.” | 14.3% | 7.2% | 10.0% | 19.7% | – |

| 6/10/02 | …the S&P 500 Index is more than 20 percent undervalued… | -10.7% | -13.3% | -12.0% | -3.1% | – |

| 4/22/02 | “Stocks are underpriced.” | -2.5% | -23.5% | -20.6% | -17.7% | – |

| 1/4/02 | …conditions are ripe for a “notable January rally.” | -7.0% | -4.2% | -15.6% | -22.4% | – |

| 11/20/01 | …maintained her bullish stance on equities. …left her equity allocation at 75 percent…year-end 2002 levels are 1,300 to 1,425 for the S&P 500… | -0.2% | -5.4% | -5.0% | -18.6% | – |

| 10/5/01 | …introduced S&P 500 fair-value rolling price targets for year-end 2002 of 1,300 to 1,425, up 22 to 33 percent from current levels. Cohen’s price range for September 2002 is 1,250 to 1,400. | 2.9% | 9.4% | 5.0% | -27.5% | – |

| 9/24/01 | …the Standard & Poor’s 500 Index, which represents about two-thirds of the market capitalization of the American stock market, will reach anywhere from 1,250 to 1,400 in the next year… “…time to buy stocks.” | 8.1% | 13.6% | 12.8% | -14.8% | – |

| 9/17/01 | …the Standard & Poor’s 500 Index…will reach anywhere from 1,250 to 1,400 in the next year… | 5.7% | 7.8% | 12.2% | -18.8% | – |

| 8/21/01 | …lowered her year-end target for the Standard & Poor’s 500 Index to 1,500… “Stock prices have already fallen to levels that are consistent with the “new reality of corporate profits.” | -13.0% | -0.6% | -4.1% | -20.7% | – |

| 4/18/01 | …overweight in technology now because they’re undervalued and the economy’s stabilizing. | 4.1% | -1.9% | -13.3% | -13.1% | – |

| 3/7/01 | …now suggests a 70 percent equity exposure in a model portfolio vs. her previous 65 percent stance… “Moderate overvaluation of the S&P 500 has been followed by notable undervaluation… We believe that attractive equity valuation has been restored and forecast year-end 2001 prices levels of 1,650 and 13,000 for the S&P and Dow Industrials,” | -8.8% | 1.7% | -10.2% | -7.6% | – |

| 2/5/01 | …the current risk in equities [is] one of time, not notable further declines in price. | -6.8% | -6.5% | -10.3% | -17.4% | – |

| 1/4/01 | …equity valuations remain attractive. She maintains a 12-month price target on the S&P 500 of 1,650, which corresponds to a roughly 23 percent increase…the S&P is roughly 20 percent undervalued… | 1.6% | -17.3% | -8.6% | -14.6% | + |

| 12/14/00 | …more favorable market environment in 2001. | -0.9% | -14.2% | -9.4% | -14.6% | – |

| 11/14/00 | …reiterated her bullish view on the market. Equity valuation, she said, has improved since March… | -3.0% | -4.8% | -7.1% | -16.8% | + |

| 10/13/00 | …the S&P 500 is 15 percent undervalued based on the Oct. 12 closing prices… “This is a fairly large buffer against fundamental disappointments.” | -1.7% | -4.0% | -14.2% | -21.1% | + |

| 9/21/00 | …reaffirmed her year-end 2000 S&P 500 target of 1,575 and her mid-year 2001 target of 1,650…the fundamental backdrop for U.S. stocks and the economy remains extremely favorable. | -3.6% | -9.9% | -22.9% | -28.3% | + |

| 7/26/00 | …share price action during the remainder of 2000 is likely to be less exciting, and more rewarding, than the first half. …rolled forward her 12-month price target for the S&P 500 to 1,650 for summer 2001. The price target for year-end 2000 is unchanged at 1,575. | 3.8% | -3.9% | -6.1% | -17.1% | + |

| 5/16/00 | Her S&P 500 price targets remain unchanged at 1,575 for year-end 2000 and at 1,625 for the spring of 2001. | 0.9% | 1.7% | -6.8% | -11.9% | – |

| 4/14/00 | …her expectation that the S&P 500 will reach the 1,575 level by the end of the year remains in place because the economy continues to look so good to her. | 8.1% | 11.3% | -2.0% | -7.6% | + |

| 4/5/00 | …she remains “enthusiastic” about stocks. | -3.7% | -2.8% | -4.1% | -23.5% | + |

| 3/28/00 | …decreased her stock allocation in a model portfolio Tuesday by 5 percent to 65 percent… “We forecast additional gains in stock prices, but expect these to occur at a slower pace.” | -2.8% | -3.5% | -4.6% | -23.0% | + |

| 3/21/00 | …raised her year-end 2000 target on the S&P 500 to 1,575… | -4.4% | -0.5% | -3.3% | -23.7% | + |

| 2/28/00 | …the S&P 500 [is] about 5 percent undervalued… …still projects the S&P 500…to reach 1,525 by year-end 2000. | 11.8% | 2.5% | 11.9% | -7.9% | + |

| 2/14/00 | “Our year-end 2000 target remains at 1,525.” | 0.2% | 2.2% | 5.9% | -4.6% | – |

| 1/28/00 | …this year will be “good but not great”… | 0.5% | 7.7% | 6.6% | 0.4% | – |

| 12/16/99 | …set a year-end target for target for the…S&P target of 1,525. | 2.6% | 2.8% | 4.2% | -6.8% | – |

| 11/29/99 | …rolled forward her 12-month price target for the S&P 500…1,475… | 4.0% | -4.2% | -2.1% | -4.7% | – |

| 10/18/99 | …the market’s recent fears — which have centered on profits, inflation and interest rates — are unwarranted. | 13.2% | 16.8% | 8.2% | 7.0% | + |

| 9/27/99 | “Stocks are undervalued.” | -0.1% | 13.6% | 19.0% | 11.2% | + |

| 9/8/99 | …increased her target on the S&P 500 index to 1,385… She set a 12-month rolling price target for the S&P 500 of 1,450. | -2.0% | 5.9% | 0.9% | 11.2% | + |

| 3/24/99 | …lifted year-end price targets for the S&P 500 to 1,325… “…recession fears are unwarranted for both 1999 and 2000.” | 7.0% | 5.3% | 3.1% | 20.4% | + |

| 1/7/99 | …slightly reduced her recommended holding of stocks in model portfolios. Cohen cut the asset allocation recommendation in stocks to 70 percent from 72 percent… Yet…remains bullish on stocks. | -2.0% | 5.8% | 9.8% | 14.8% | + |

| 12/28/98 | S&P 500: 1275 at end of 1999 | 3.6% | 7.6% | 13.3% | 14.2% | – |