Do top-performing mutual funds reliably continue to be top performers. In their June 2012 semiannual report entitled “Does Past Performance Matter? S&P Persistence Scorecard”, Standard and Poor’s summarizes performance persistence statistics for U.S. mutual funds overall and for funds grouped by capitalization focus of holdings. They measure persistence of the top 25% (quartile) and top half of funds across multiple subsequent years and frequency of migration of all performance quartiles from one multi-year interval to the next. Using annual performance data for a broad sample of U.S. mutual funds during March 2002 through March 2012, they find that:

- Only 4.05% (19.6%) of mutual funds in the top performance quartile (half) as of March 2010 persist in the top quartile (half) for both of the next two years, compared to 6.25% (25%) for random expectations.

- Only 0.93% (5.22%) of mutual funds in the top performance quartile (half) as of March 2008 persist in the top quartile (half) for all of the next four years, compared to 0.39% (6.25%) for random expectations.

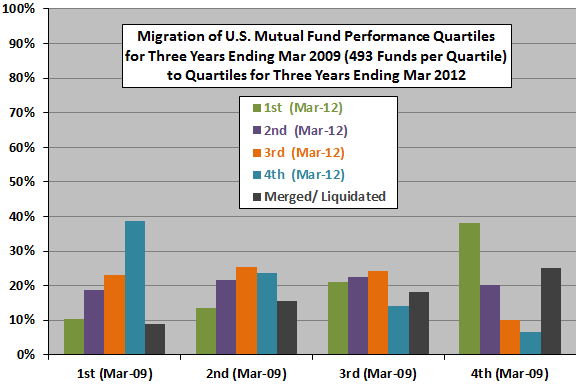

- There is some tendency toward reversal of fortune of the best and worst funds across consecutive, non-overlapping three-year and five-year performance intervals (see the chart below).

- Results are generally consistent across groups of funds segmented by stock capitalization focus (size style).

The following chart, constructed from data in the summary, summarizes migration of mutual funds from three-year performance quartiles ending March 2009 to performance quartiles for the next three years. Each quartile contains 493 funds. Funds in the top (bottom) quartile during the first three-year interval are most likely to be in the bottom (top) quartile during the subsequent three-year interval. However, funds in the bottom quartile during the first interval are most likely to disappear during the next interval.

In summary, evidence casts doubt on the existence of U.S. mutual fund manager skill and indicates that fund performance is more likely to reverse than persist.

Cautions regarding findings include:

- Since the report does not address factors related to performance persistence, findings do not obviously translate into a fund switching strategy.

- Performance measurements address size of holdings but not other factors commonly applied to alpha (book-to-market and momentum).